You have your ideal company list locked and loaded. The firmographics seem right: right industry, right revenue, right employee count. But your campaigns still fall flat. Why?

Because you’re targeting companies, not people, this is the costly mistake most B2B teams make in confusing firmographic data (company level) with demographic data (individual level). What happens as a result? Messages land in the wrong inboxes, sales calls reach gatekeepers instead of decision-makers, and marketing budgets drip down to campaigns that never convert.

Understanding B2B demographic data is the missing link between identifying a target company and actually closing a deal.

B2B demographic data refers to information about a person in a business, including job title, seniority level, department, education, and work experience. It is used to identify the right decision-maker for sales or marketing campaigns.

In this guide, we are going to cover what B2B demographic data includes, how it differs from firmographic data, and some very practical ways to use the data for smarter targeting and faster conversions.

What Is B2B Demographic Data?

B2B demographic data: personal and professional attributes of the people working in a business. These include job title, seniority level, department, years of experience, education background, and decision-making authority.

Whereas consumer demographics focused on personal traits, such as age, gender, income, and marital status, B2B demographics zero in on a person’s professional identity. It’s not about who someone is at home. It’s about who they are at work: what they do, where they sit in the org chart, and whether they have the power to sign off on a purchase.

This distinction matters more than ever. In modern B2B environments, generic outreach doesn’t cut it. Buyers expect personalization. AI-powered tools now enable hyper-targeted campaigns, but they’re only as effective as the data behind them. Without accurate demographic data, your ICP stays incomplete-and your sales team wastes time chasing contacts who can’t actually buy.

This is the data that sales teams, marketers, and revenue operations professionals rely on to solve one core problem: how to reach the right people inside the right companies. That’s what B2B demographic data does: it bridges that gap by moving you from targeting accounts to targeting the actual decision-makers who buy.

Why B2B Demographic Data Matters More Than Ever

B2B buying has changed. The committees are larger, sales cycles are longer, and decision-makers are hard to reach. What worked a decade ago does nothing more today than drain budgets and annoy prospects. Today, the teams that win are the ones who know exactly who they’re talking to before the first email is ever sent.

Here’s why B2B demographic data is imperative for modern sales and marketing teams.

The Shift From Broad Targeting to Precision Marketing

Mass marketing in B2B is dead. Buyers get hundreds of pitches coming their way on any given day, and they learn how to tune them out. The shift toward account-based marketing and precision targeting means teams can no longer afford to blast messages to entire companies and hope someone relevant responds.

Demographic data makes this possible. Instead of targeting “tech companies with 500+ employees,” you can target the VP of Engineering at those companies who has budget authority and a history of adopting new tools. That’s what makes the difference between noise and relevance.

Rising CAC and the Need for Better Segmentation

Acquisition costs are skyrocketing across all B2B industries, with greater competition in marketing channels, ever-increasing ad costs, and decreased time for sales representatives to chase after unqualified leads.

Better segmentation is the antidote. Demographic data can help filter prospects by seniority, department, and decision-making power, thus you are not wasting resources on people who were never going to buy. Every dollar goes further, and your cost-per-opportunity drops. In a market where efficiency wins, demographic segmentation isn’t optional-it’s survival.

Why Sales Teams Rely on Demographic Indicators to Qualify Leads

Just because somebody downloaded an e-book doesn’t mean this is a qualified lead. Sales teams need context – was this person senior enough to make a decision? Are they in the right department? Do they have purchasing authority?

Demographic indicators answer these questions right away:

- Title of job discloses influence and scope of responsibility

- Seniority level signals access to the budget and decision-making power.

- Department confirms whether your solution is relevant to their role.

Without this data, sales reps burn hours chasing contacts who can’t move a deal forward. With it, they are focusing on the leads most likely to convert-and bypassing the ones who never had a chance.

How Demographic Data Improves Personalization at Scale

Personalization drives results, but you cannot scale personalization without data. Knowing the prospect’s role, experience level, and professional background lets you tailor messaging that actually resonates.

Different buyers care about different things:

- A CFO wants to hear about ROI and cost savings.

- A marketing director focuses on campaign performance and lead quality.

- A technical buyer needs integrations, specs, and implementation details.

Demographic data lets you speak the language of each buyer, automatically across thousands of contacts, without sacrificing relevance. That’s how modern teams turn cold outreach into warm conversations.

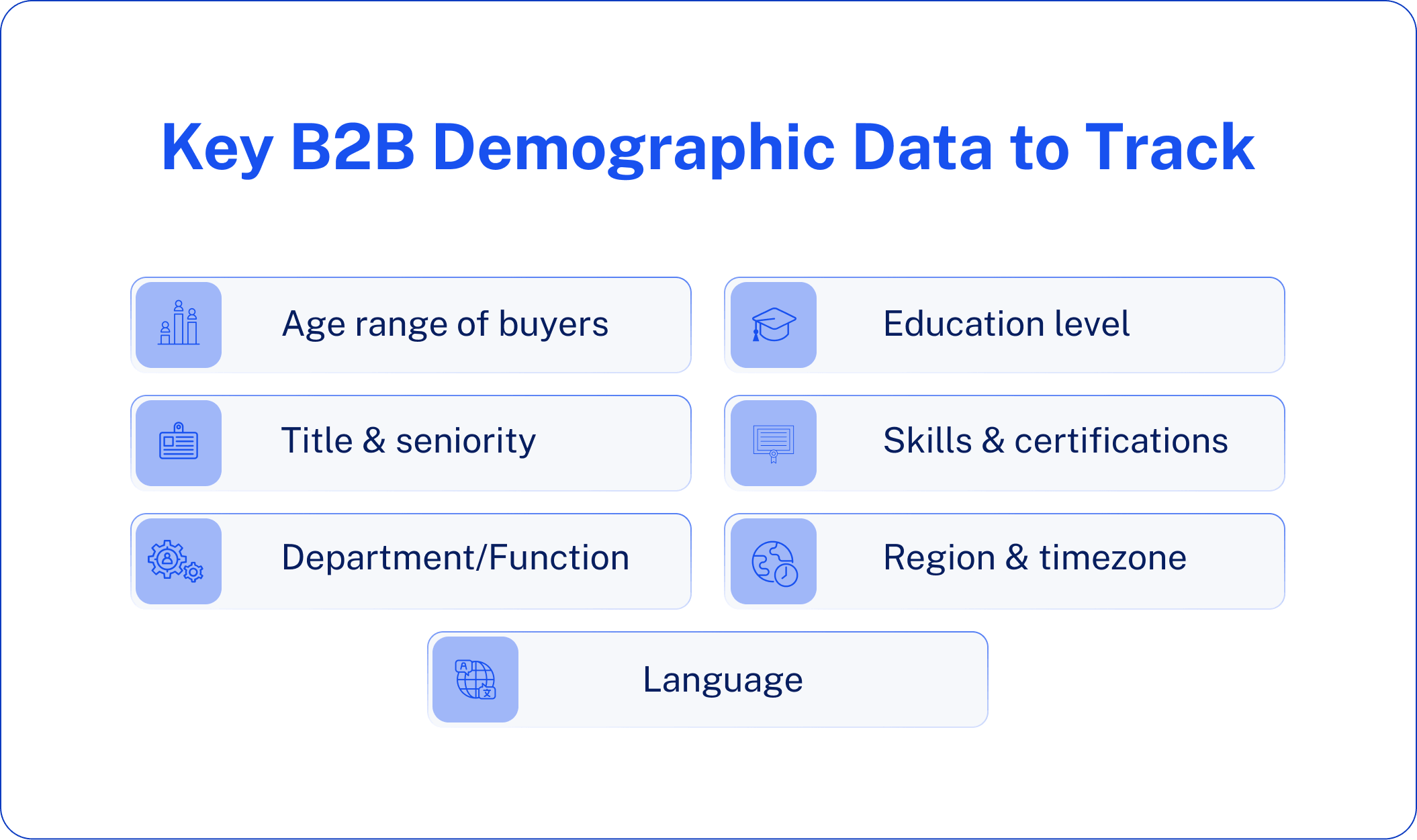

Key B2B Demographic Data Points You Should Be Tracking

Not all demographic data is created equal. Some are the fields of necessity when it comes to targeting; others fall into nice-to-haves. The key is to know which data points actually move the needle for your sales and marketing efforts.

Here are the B2B demographic data points high-performing teams focus on.

Age Ranges of Decision-Makers

Age can seem like a B2C measure, though it has a minor influence in B2B. The differences between generations affect the preferences of communication, the use of technology, and purchase behavior. A Gen X executive might lead in the use of phone calls and official offers. Slack messages and video demos may work better with a millennial manager.

Tracking age ranges enables you to tailor both your channel strategy and your messaging tone without assuming things that might fall short.

Job Titles and Seniority Levels

This is the most critical demographic data point in B2B. The job title can tell you what someone does; seniority can tell you how much power they have.

Targeting by title and seniority allows you to:

- Decision-makers vs. Influencers vs. End-users

- Focus outreach on contacts with the budget authority

- Tailor messaging to hit on role-specific pain points

A well-structured title and seniority taxonomy form the backbone of any effective B2B targeting strategy.

Department / Functional Role

The department someone is working in tells if your product is even relevant to them. Automation software for sales cares about the sales team, not HR. A cybersecurity platform matters to IT and not to marketing.

Department data enables you to map out buying committees. Most B2B purchases involve several stakeholders across multiple functions; understanding which departments are involved helps you build multi-threaded outreach strategies that cover all decision-makers.

Education Background

Education data provides an additional layer of context to a prospect profile: it can signal expertise, seniority trajectory-even cultural fit-through degrees, institutions, and fields of study.

For instance:

- An MBA may signal strategic and business-focused thinking.

- A technical degree suggests hands-on expertise and attention to detail.

- Prestige may imply a correlation with certain industries or company tiers.

Education is not a qualifying factor in and of itself, but it enriches your understanding of who you are speaking to.

Skills, Certifications, and Specialties

Skills data gives you an idea of what your prospects actually do, instead of just what their title says. Certifications and specializations are extremely valuable to technical salespeople, where knowing that a prospect has an AWS certification or a PMP credential can shape an entire pitch.

According to resources, 86% of B2B customers expect companies to be well-informed about them during interactions. Skills and certifications data help you meet that expectation by showing prospects you understand their expertise, not just their job title.

This information helps you:

- Identify prospects that have experience relevant to your solution.

- Personalize outreach based on technical proficiency.

- Qualify leads based on hands-on experience, not just job titles.

Location Details (Region, Timezone, HQ Proximity)

Location information is not geography. It concerns time zone consideration, outreach, regional compliance, and even language preference.

The major points of location data are:

- Region/country: for territorial assignment and for regulatory awareness

- Timezone: for scheduling calls and sending emails at optimal times

- HQ proximity: to understand if you reach the headquarters or a satellite office

For global teams, location-based data helps teams coordinate outreach without crossing wires or skipping opportunities.

Language Preferences

Language can make or break an international B2B sales deal. Sending a French-speaking prospect in Quebec or a German buyer in Munich, English-only content is a clear sign that you haven’t done your homework.

Tracking language preferences enables you to:

- Localize email campaigns, sales collateral

- Assign leads to reps that speak the language of the prospect

- Build trust by communicating in the buyer’s native tongue.

Why These Data Points Matter for Targeting Accuracy

All these demographic fields provide an additional specification to your targeting. Each of them contributes to your filtration and segregation; all combined, they create a complete portrait of who your ideal buyer is.

As long as your data is correct and complete, the guessing comes to an end, and you begin to get the right people to get the right message at the right time. It is what will make the difference between generic outreach campaigns and high conversion campaigns, and ultimately, it is what makes the difference between teams that perform poorly and teams that go to scale.

B2B Demographics vs Firmographics vs Technographics

The effective B2B targeting requires more than one type of data. Demographics, firmographics, and technographics each answer different questions-and together, they give you a complete view of who you’re selling to.

Understanding the difference between these three data types is crucial in building accurate ICPs, segmenting audiences, and creating outreach that actually converts.

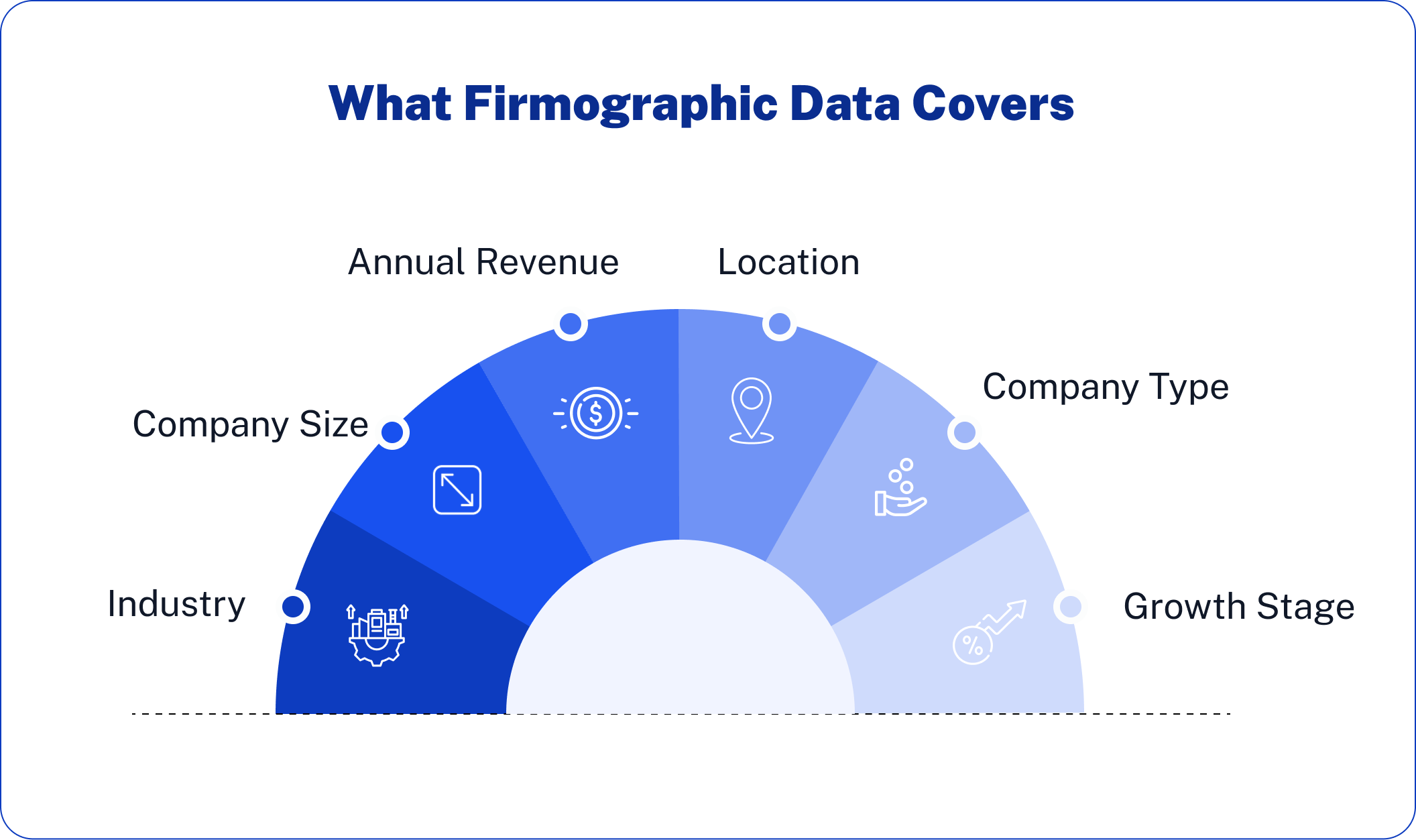

What Firmographic Data Covers

Firmographic data denotes information about the company itself. Consider it the “demographics” of an organization-the basic things that define what a business is and how that business operates.

Common firmographic data includes:

- Industry: In what industry does this business function?

- Company size: How many people work for them?

- Annual revenue: What’s their scale financially?

- Location: Where is the headquarters? Do they have several offices?

- Company type: Are they a startup, SMB, or enterprise? Public or private?

- Growth stage: Are they scaling, stable, or contracting?

Firmographics will help you answer whether this is the right type of company for our solution.

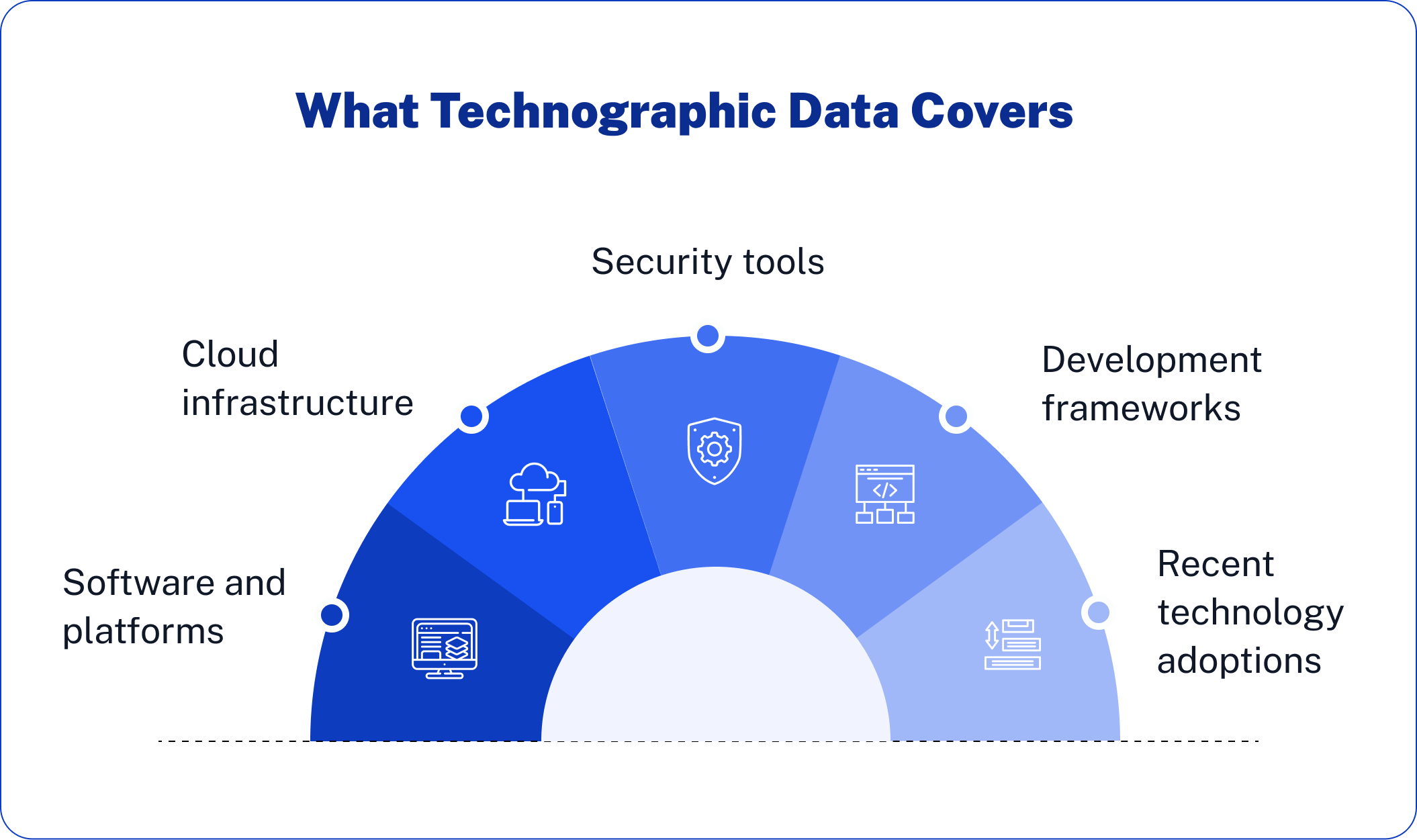

What Technographic Data Reveals

Technographic data informs about the technology that a company utilizes. It reveals the tools, platforms, and systems comprising their current tech stack and can give you insight into their operational maturity and the compatibility potential for your product.

Common technographic data may include:

- Software and platforms: Which CRM, ERP, and marketing tools do they use?

- Cloud Infrastructure: Are they AWS, Azure, or Google Cloud?

- Security and management tools: What are the cybersecurity solutions?

- Development frameworks: What does their engineering team develop in?

- New technology adoption: Have they recently embraced new technology?

Technographics help you answer: Is this company likely to need or integrate with our solution?

How Demographic Data Completes the Picture

Firmographics tell you about the company. Technographics tells you about their tools. But demographic data tells you about the people inside that company, the people who will actually evaluate, champion, and approve your solution.

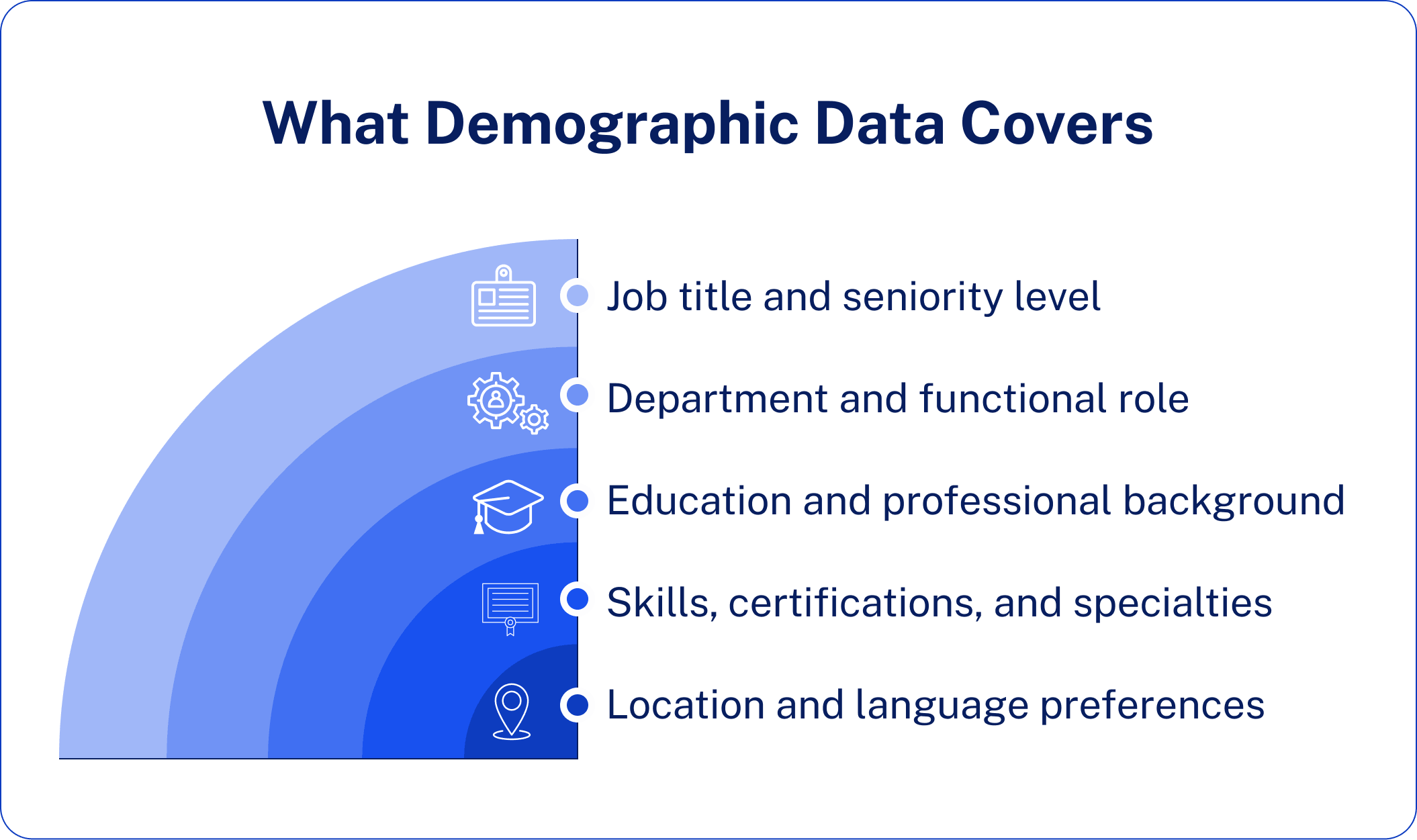

As discussed above, B2B demographic data involves:

- Job title and seniority level

- Department and functional role

- Education and Professional Background

- Skills, Certifications, and Specialties

- Location and language settings

Demographics help you to answer: Who is the right person to talk to, and how shall we approach them?

Without demographic data, you may reach the right company that has the right tech stack, yet still waste a lot of time talking to someone who has absolutely no authority to make decisions. Demographics help in completing the picture by connecting you with the humans behind the business.

Examples: When Each Type Is Most Useful

Use firmographics when: building your target account list and looking to filter based on such criteria as industry, company size, or revenue. For instance, firmographic filters would be a B2B SaaS company that targets middle-market healthcare organizations.

Use technographics when: you sell a product that integrates with or replaces existing tools. As an example, if you are selling an add-on for Salesforce, the technographic data allows you to source firms already using Salesforce.

Use demographics when: you are identifying the right contacts within target accounts and personalizing outreach. For example, if marketing teams use your product, demographic data helps you find the VP of Marketing or Director of Demand Gen—not just anyone at the company.

Use all three when: You are running ABM campaigns, and you want precision for every level in the campaign-right company, right tech fit, and right decision-maker.

| Data Type | What It Describes | Key Data Points | Best Used For |

| Firmographics | The company | Industry, size, revenue, location, growth stage | Building target account lists, qualifying companies |

| Technographics | The tech stack | Software, platforms, infrastructure, and recent adoptions | Identifying integration fit, competitive displacement |

| Demographics | The people | Job title, seniority, department, skills, education | Finding decision-makers, personalizing outreach |

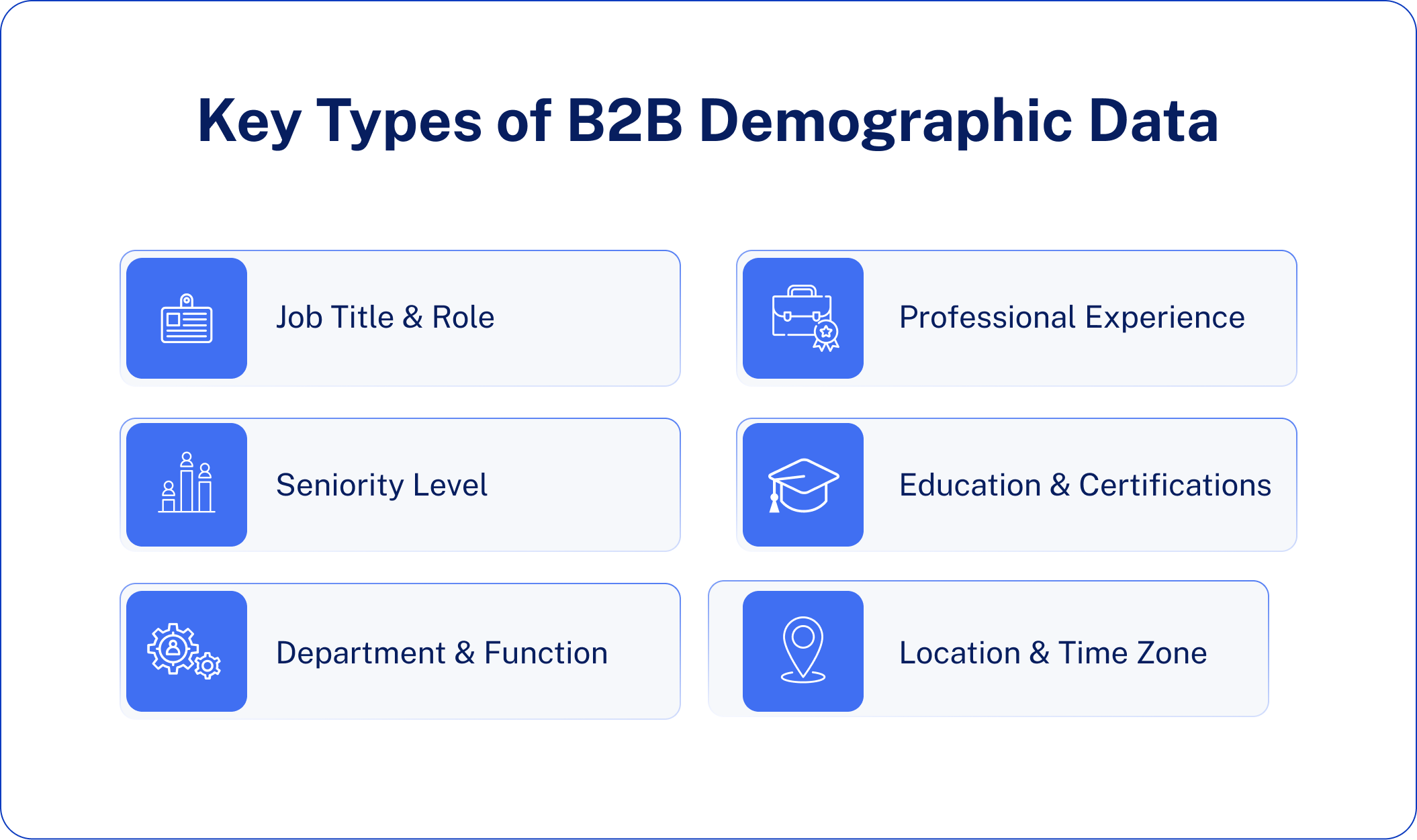

Key Types of B2B Demographic Data

Now that you understand why this type of demographic data matters, let’s dig deeper into each one. Knowing what to track is only half the battle; you also need to understand how to use each one effectively. All too often, the difference between a generic campaign and a converting one comes down to exactly how well you understand and apply those singular data points. Here’s what each reveals and how to make it work in your targeting strategy.

Job Title & Role

Job title is the most commonly used demographic filter in B2B targeting-and for good reason. It tells you what someone does, and gives you a starting point to understand their priorities.

Why it matters for reaching decision-makers: Job titles help you distinguish between people who can make purchasing decisions and people who can’t. Getting in front of the right title determines if you closed a deal or get sent to spam.

Examples:

- Target a CMO-you’re probably pitching strategic value: brand growth, competitive positioning, and high-level ROI. Messaging must be focused on business outcomes, not features.

- Targeting a Marketing Manager: You’re informing someone who can probably affect the decision, but isn’t the final approver. Messaging should focus on day-to-day pain points, ease of use, and how the product makes their job easier.

Both are legitimate targets, but they would require different approaches. Job title data lets you tailor accordingly.

Seniority Level

Job titles are often inconsistent across companies-a “Director” at a startup may have the same responsibilities as a “Manager” at an enterprise. Seniority level adds a standardized layer that explains where someone sits in the organizational hierarchy.

Common levels of seniority include:

- C-suite roles: CEO, CFO, CMO, CTO, etc.

- VP: Vice President of Sales, VP of Engineering

- Director: Director of Marketing, Director of IT

- Manager: Product Manager, Marketing Manager

- Individual Contributor (IC): Specialist, Analyst, Coordinator

The impact of seniority on purchasing power: Generally, the seniority, the more budgetary power. C-suite and VP-level contacts typically have the final sign-off authority, whereas Directors and Managers might be influential in the decisions but often need to get approval from above. Individual Contributors seldom have purchasing authority but may be very strong champions internally.

Understanding seniority helps you to prioritize outreach and craft your messaging to the level of authority of each contact.

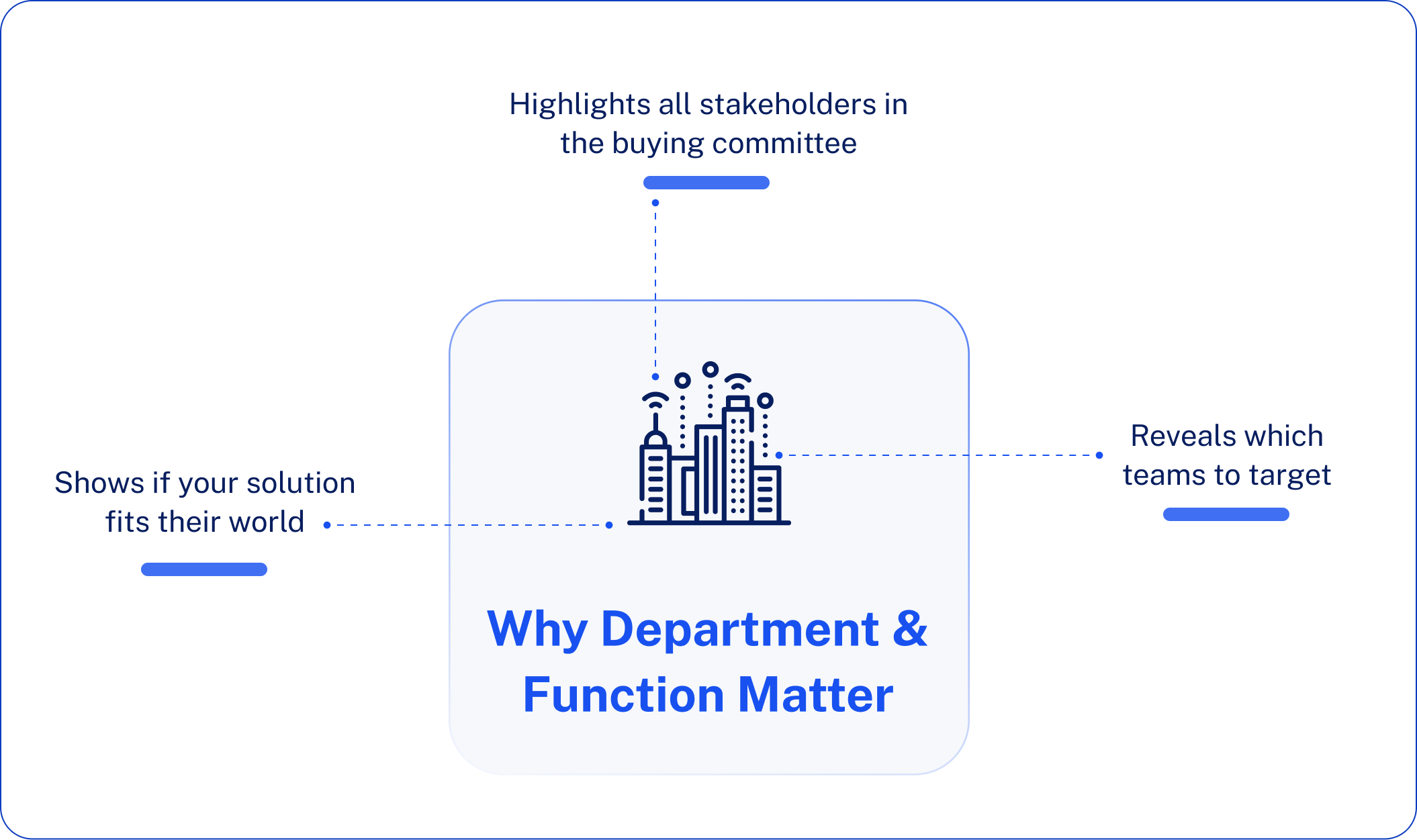

Department & Function

Knowing someone’s department informs you if your solution is relevant to their world. A sales enablement platform matters to the Sales and Revenue teams-not to HR or Legal.

Targeting by department:

- Marketing: demand creation software, analytics, and content software.

- IT: Security, infrastructure, integrations, dev tools.

- Finance: Spend management, forecasting, and accounting software.

- Products: supply chain, logistics, workflow automation.

- HR: recruiting platforms, payroll systems, employee engagement tools

Cross-functional buying committees: The majority of B2B buying implies more than two departments. An Increased in a marketing automation platform would involve agreement by Marketing’s desired primary user and IT-security, and integration, as well as Financial-budget approval. The data provided by the department assists you in monitoring all the players involved, not necessarily the obvious ones only.

Professional Experience

The richness of years of experience and career trajectory within your prospect profiles adds nuance. Two people with the same job title can have very different needs depending on how long they’ve been in the role.

How message needs vary by experience level:

- Newer to the role: These may need more education, guidance, and hand-holding. They often are still learning the landscape and are more open to recommendations.

- Seasoned veterans: Already know what they want. They’re less interested in education, more focused on differentiation, ROI, and proof points. Go straight to the value, skip the basics.

Experience data signals career trajectory, too. The person who’s been promoted fast is probably an ambitious change-maker likely to champion new tools. A person who’s stayed in the same role for ten years probably likes stability and proven solutions.

Education & Certifications

Not everyone considers education data the most important filter, but in some cases, it does.

When it matters:

- Technical products: if your buyers are engineers or developers, it certainly helps to understand the language of a prospect with an AWS certification, a PMP credential, or a computer science degree.

- Regulated industries: In healthcare, finance, or legal sectors, a particular degree or certification can provide a quick way to know if someone has the expertise to assess your solution: CPA, JD, or MD.

How to use it without over-filtering: Education data should enhance, not constrain, your targeting. Over-filtering based on degree or certification risks shrinking your addressable market unnecessarily. Employ it for the personalization of messaging-not for excluding otherwise qualified leads.

Location & Time Zone

Location data extends beyond simple geography. It helps enlighten from territory assignment to outreach timing to language preference.

Geographic targeting, also for regional campaigns:

- Regional compliance requirements: GDPR in Europe, CCPA in California

- Territory-based sales assignments

- Localised messaging and cultural relevance

- Event and field marketing targeting

Remote work considerations in 2025: Now that working remotely and hybrid work have become the standard in many industries, a prospect’s location doesn’t necessarily match up with where their company headquarters is. A prospect works for a New York-based company but resides in Austin. Location data should capture where the person is, not just where the company is.

Time zone awareness: Sending an email at 9 AM your time might land at 6 AM theirs. Scheduling a demo at 3 PM EST might be midnight for a prospect in Singapore. Time zone data ensures that your outreach lands at the right moment rather than when it’s guaranteed to be ignored.

Each of those pieces of information adds precision to your targeting. Individually, they help you sift and sort. Taken together, they present you with the complete picture of who you want to reach and how best to reach those people.

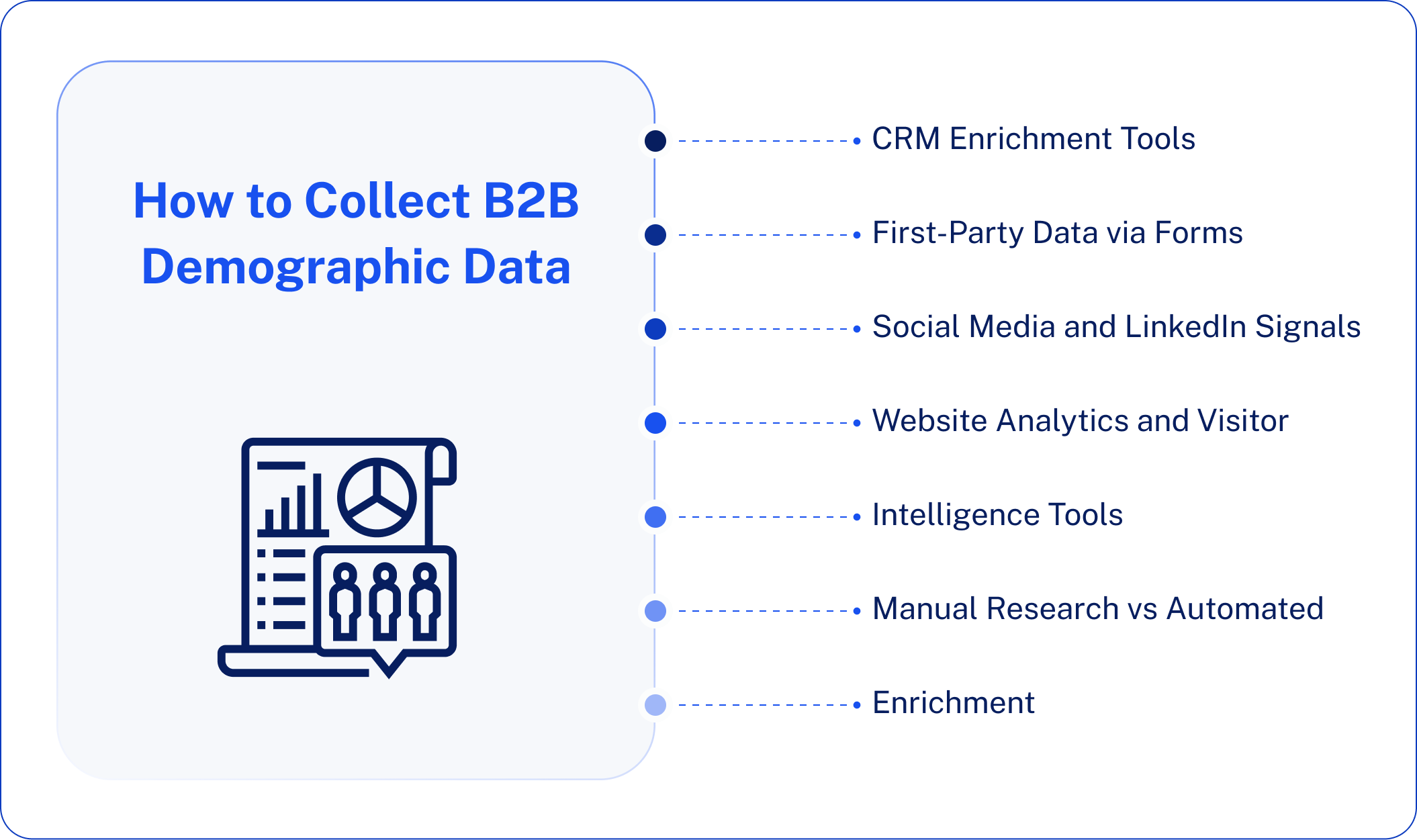

How to Collect B2B Demographic Data

Knowing what demographic data you should track is one thing. Actually getting that data correctly and at scale is a whole different story.

The good news is that there are now more ways than ever to collect B2B demographic data. The key is choosing the right mix of tools and methods based on your budget, team size, and data quality requirements.

CRM Enrichment Tools

CRM enrichment tools automatically append demographic data to your existing contacts and accounts. Rather than manually researching every lead, these platforms pull from public sources, proprietary databases, and AI-powered signals to round out your incomplete records.

Some popular B2B data enrichment tools include:

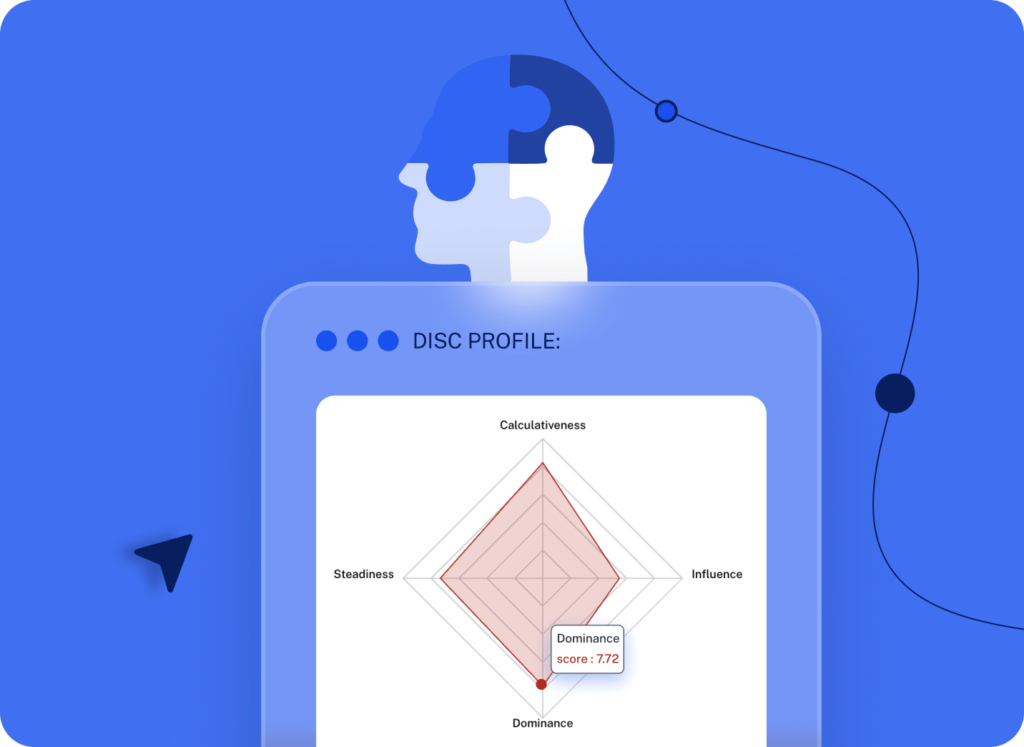

- AI Ark: AI-driven B2B data platform providing both demographic and firmographic data with advanced filtering by job title, seniority, department, and more

- ZoomInfo: One of the largest B2B databases, offering job titles, seniority, department, direct dials, and org charts.

- Apollo: combines prospecting and enrichment, along with strong filtering by role, seniority, and function

- Clay: A flexible data enrichment platform; pulls in data from several sources and can create custom workflows.

- Clearbit: Real-time enrichment that integrates directly with CRMs and marketing automation platforms

These tools save hours of manual work and keep your CRM data fresh. Most of them integrate directly with Salesforce, HubSpot, and other major platforms.

First-Party Data via Forms

First-party data is information your prospects willingly provide, which remains one of the most reliable sources for demographic data. It comes directly from the source, so it is more accurate and leaves no guesswork.

Common ways to gather first-party demographic data:

- Lead capture forms: ask for job title, company, and department at the point of content download or demo requests.

- Progressive profiling: Instead of asking everything at once, progressively gather more data across multiple interactions.

- Surveys and assessments: Provide value in exchange, such as a benchmark report, for detailed professional information

- Event registrations: Webinars, conferences, and workshops often have role and seniority collected during sign-up.

The tradeoff: the greater the number of fields you have, the lower your conversion rate. Keep forms short for top-of-funnel content and save detailed questions for high-intent interactions, like demo requests.

Social Media and LinkedIn Signals

LinkedIn is the richest source of B2B demographic data available publicly. Job titles, career history, education, certifications, and skills-all there, often self-reported and regularly updated.

Ways to Utilize LinkedIn for Demographic Data:

- LinkedIn Sales Navigator: Advanced search filters include title, seniority, function, and years in role

- Profile scraping tools: Platforms that scrape publicly available data off LinkedIn, well within the platform’s terms of service.

- Social listening: track job changes, promotions, and career moves to identify timing-based opportunities

- LinkedIn Ads audience insights: utilizing campaign data to understand the makeup of who’s engaging with your content.

Going beyond LinkedIn, professional interests, affiliations, and areas of expertise can also be mined from platforms like X (Twitter) and other industry-specific communities, though this is less structured and harder to scale.

Website Analytics and Visitor Intelligence Tools

Your website visitors are already telling you who they are if you know how to listen. Visitor intelligence tools de-anonymize traffic and show you which companies-and sometimes which individual people-are browsing your site.

Key tools in this category include:

- Clearbit Reveal: Identifies companies visiting your site, and enhances them with firmographic and demographic information.

- 6sense: Uses intent signals and AI to identify accounts in-market and the personas engaging with your content

- Leadfeeder: tracks which companies have visited your site and what pages they view.

- HubSpot/Google Analytics: less granular, may be able to show behavior tied to known contacts.

It is, however, particularly strong for sales teams: knowing that a VP of Marketing from a target account just spent 10 minutes on your pricing page is actionable insight, even before they fill out a form.

Manual Research vs Automated Enrichment

Not all data collection has to be automated. Sometimes, manual research will yield much higher accuracy-especially when it comes to strategic accounts.

When manual research makes sense:

- High-value target accounts where accuracy is crucial

- Niche industries where automated tools have limited data coverage.

- Validating or supplementing enriched data before outreach

- Building out detailed org charts for complex buying committees

When automated enrichment wins:

- Scaling Data Collection Across Thousands of Leads

- Keep the CRM data up to date.

- Reduce the time taken in repetitive research duties.

- Helps enable real-time personalization of marketing campaigns

The best teams do both. Automate the bulk of your data collection and then layer in the manual research for your highest-priority accounts.

What’s Most Accurate? A Reality Check

No source is 100% correct. Job titles change, people get promoted, and databases get stale. Here’s how the different data sources typically stack up:

| Data Source | Accuracy Level | Best For |

| First-party forms | Highest | High-intent leads who self-report |

| LinkedIn (manual) | High | Strategic accounts, recent job changes |

| CRM enrichment tools | Medium-High | Scaling data collection, bulk enrichment |

| Visitor intelligence | Medium | Identifying anonymous traffic, intent signals |

| Third-party databases | Varies | Broad prospecting, initial segmentation |

Pro tip: Combine a number of sources in one profile to cross-validate. If the enrichment tool says someone is a “Marketing Manager,” but their LinkedIn says “Director of Demand Gen,” trust the more recent source. The best data strategies layer first-party, enriched, and manually verified data for maximum accuracy.

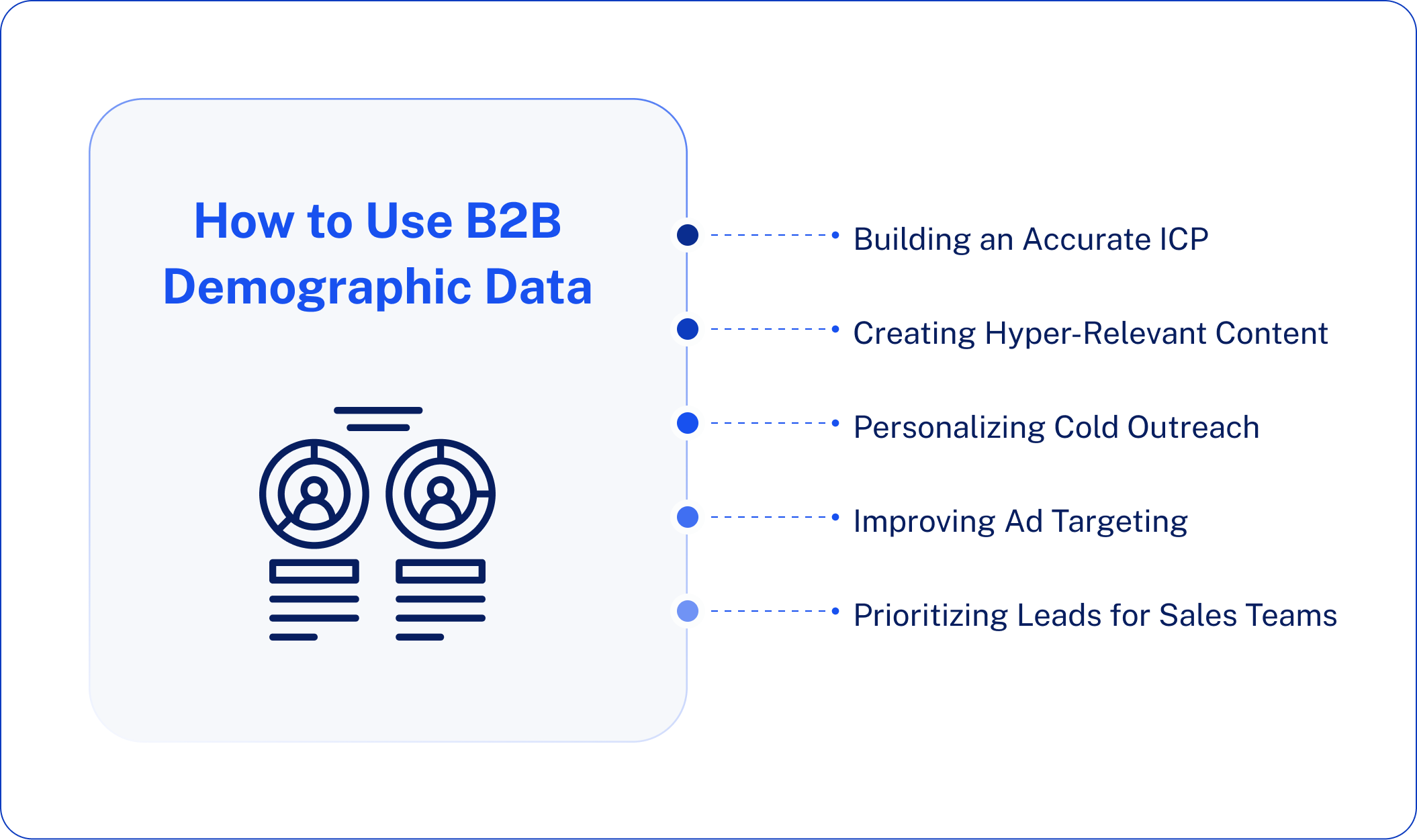

How to Use B2B Demographic Data to Improve Targeting

Getting demographic information is only part of the equation. Where you derive true value, though, is by leveraging that information, refining your ideal customer profile, extending personal touches, and steering sales teams towards qualified prospects.

Building an Accurate ICP

Your ideal customer profile likely started with firmographics: industry, company size, and revenue range. But an ICP built on just company attributes misses the humans who actually buy.

Start by analyzing your closed-won deals from the last 12 months. Look beyond the company name and ask: who was the one to initiate the conversation? What was the title? How senior were they? Which department did they sit in? Patterns will emerge. Maybe Directors of Operations close faster than VPs. Maybe Finance leads convert at twice the rate of IT leads for your product.

Layer these demographic insights onto your firmographic criteria. A good ICP reads less like “mid-market SaaS companies” and more like “Senior IT Managers at mid-market SaaS companies with 200-500 employees who are currently using legacy on-prem solutions.” It’s the specificity that makes every downstream activity, content, outreach, and advertising more effective.

Revisit this quarterly. Your ICP should evolve as you close more deals and learn who actually buys versus who just takes meetings.

Creating Hyper-Relevant Content for Each Segment

Generic content gets ignored. A CFO buying your platform cares about ROI, risk mitigation, and total cost of ownership. A Marketing Director at the same company wants to know about campaign performance and time-to-value. Same product, complete different conversations.

That doesn’t mean you have to create distinct content libraries for each of your personas. Sometimes it’s far easier than this: write various introductions to the same case study, provide executive summaries that sit alongside detailed implementation guides, or gate an ROI calculator for senior titles and offer ungated tactical content to practitioners.

The goal is the meet each segment where they are. Executives want strategic outcomes. Managers want efficiency gains and tools that make their teams better. Technical buyers want documentation and proof that your product won’t create more problems than it solves.

Personalizing Cold Outreach Based on Seniority + Role

Cold outreach won’t work when it seems like it’s from a template. With demographic information, you’ll know what you’re talking about and be able to make messages that resonate.

The Outreach Personalization Matrix

| Executive (VP+) | Manager | Individual Contributor | |

| Opening | Lead with a business problem | Lead with a team challenge | Lead with daily friction |

| Value prop | Strategic outcomes, revenue impact | Efficiency, making their team look good | Ease of use, time savings |

| CTA | Brief call, send to delegate | Demo, resource share | Free trial, hands-on content |

| Tone | Direct, minimal fluff | Balanced | More detail is okay |

Seniority and role are what you want in a receiving person. A VP fresh from promotion may value as much information as a Director with a decade of experience in this role, who has been waiting for you to get to the point. A tech-savvy Manager has different proof points than his commercial counterpart.

Use demographic information in your outreach flows, and craft variations that take these differences into account. Small changes, such as from “drive revenue growth” to “help your team save 5 hours a week,” can drive a marked increase in response rates.

Improving Ad Targeting and Exclusion Filters

Demographic data refines targeted spending in two ways: reaching the intended audience, as well as stopping spending on those who are undesired.

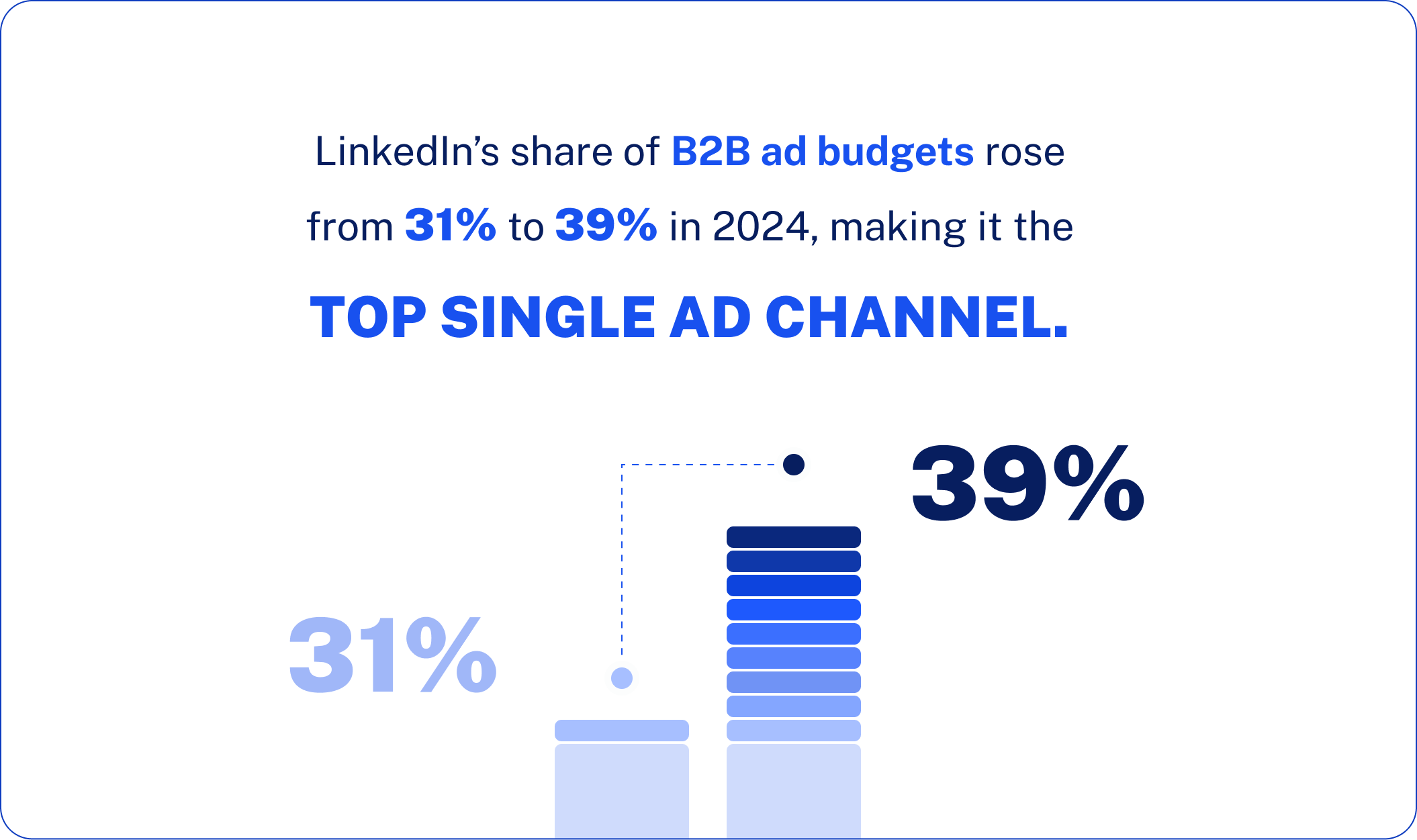

If your closed-win data indicates that Directors and VPs are three times as likely to convert as Managers, you should allocate your budget towards those title buckets. Also, if your Marketing titles are performing better than Sales titles in your product, you should limit your targeting to those titles. LinkedIn, like most B2B platforms, provides you with the functionality of filtering by title, role, seniority, and experience. Use it.

This, in turn, has led marketers’ attitudes to shift in many ways, including that “marketers are increasingly doing exactly that. LinkedIn’s share of total B2B ad budgets increased from 31% to 39% in 2024, making it the largest single-channel budget due in large part to demographic and firmographic targeting.”

Exclusions are just as valuable. Stop paying for your ads to show to interns, entry-level positions outside of your buyer profile, and departments that never convert. A missed trick would be to suppress your existing customers and available opportunities by targeting against your CRM. No point in showing your ads to people your sales teams are already working with.

Prioritizing Leads for Sales Teams

Not all leads are such that they require immediate attention. Demographic scoring can be used to bring out those prospects that are most likely to close, hence sales can focus on them.

Give points depending on fit to your ICP. A Director in your main department of purchase rates higher than a Coordinator in a separate department. The length of time in a job may also mean budget authority; less than two years may not. Titles of decision-makers have more points than titles of influencers or end-users.

Combine demographic scores with behavioral signals like pricing page visits, content downloads, and email engagement for a complete picture. A Marketing Director who comes to your pricing page twice is friendlier than a CMO who downloaded one of your top-of-funnel ebooks six months ago.

Establish set limits that initiate measures: above a specific score will go to sales; mid-range scores will be fed to a nurture program, whereas low scores will be kept in a marketing automation program until intent signs get better.

The key is calibration. Compare scores against actual conversion rates monthly and adjust weights based on what the data shows you. A scoring model that never gets updated is just guesswork with numbers attached.

Common Mistakes Companies Make With B2B Demographic Data

Sales and marketing departments know that demographics are important. However, most sales and marketing teams do not use this information effectively. This represents where the agreements are killed, as opposed to being lost due to a lack of understanding.

Now, this is where companies are going wrong.

Treating All Job Titles the Same

A Director at a 50-person startup is very different from a Director at a Fortune 500 company. The former may own the budget, make final decisions on tool selection, and drive the implementation all by themselves. The latter may be one voice among dozens, and without spending authority above $5K.

Yet most teams treat “Director” as a single segment. They send the same emails, run the same ads, and wonder why response rates vary wildly.

The title alone tells you almost nothing. You need the context around it:

- Company size and structure

- Seniority as related to the organization

- Department and reporting lines

- Years in the current position and path of career path

The head of marketing in a series A company has more in common with a CMO at a mid-market firm than with another “Head of Marketing” at an enterprise. Segment accordingly.

Relying Only on Firmographics Without Demographic Layers

Firmographics, such as industry, company size, and revenue, are table stakes. It helps to have a target account list. But it doesn’t tell you who to talk to or what to say.

Two companies can hit all of your firmographic ICP criteria, and completely different methodologies apply. One may have centralized procurement in which everything flows through IT. The other may allow department heads to buy tools on their own. Same industry, same size, totally different paths to a deal.

Demographic data fills this gap. It tells you which titles hold budget authority, which departments drive purchases, and how experienced the typical buyer is. Without it, you’re targeting companies, not people-and companies don’t sign contracts.

Ignoring the Buying Committee

“The biggest blunder that B2B salespeople make is when their optimization model is for one buyer, whereas in most B2B sales, five, ten, or even more buyers are involved.”

According to a report by Gartner, “typically, a purchasing group in a B2B environment has between six to ten decision-makers; for a complex purchase, this number can rise to as many as twenty.” Every person involved in a purchase has his or her own role to play:

- Economic Buyer: This is an individual who possesses control over money and permission to spend.

- Technical Evaluator: Integration, security, and implementability review.

- End user: Lives with the product on a day-to-day basis and can promote it.

- Executive sponsor: Provides air support, pushes the transactions beyond the in-house resistance.

If your targeting effort only focuses on the economic buyer, you’re missing the tech eval person who can, in a matter of seconds, end an agreement over integration issues. And if your targeting effort only hits the end-user, you never develop that level of sponsorship that would result in budget appropriation.

Understand your buying committee. Use this to map your product’s buying committee. Then, develop your targeting and content for each, not just for who signs the check.

Using Outdated Demographic Datasets

People change Jobs. They are promoted, move companies, move departments. Seven people are recruited every minute, as a matter of fact, through LinkedIn alone. This data, which was true six months ago, may no longer be true.

Using outdated information can hurt your outreach efforts; it can even harm your brand. There’s no quicker way to communicate “I don’t know you” than when your email blows your prospect’s current title out of proportion.

“The solution is not accumulating more data. Refresh cycles, which involve re-running analyses with updated data, should be incorporated into your

- Verify contact data for large-scale campaigns.

- Rely on intent data and engagement metrics to validate that prospects remain actively engaged.

- Select your enrichment tools to be up-to-date, rather than using databases that are stale as soon as you compile them.

- Bounced emails and wrong-number calls were recognized as immediate data cleanup triggers.

Over-Generalizing Personas

Until B2B marketing evolved, “Marketing Mary” and “IT Ian” made some sense. Now, they are a crutch, so real understanding is not achieved.

When personas get too generic, they cease to be helpful. Three paragraphs describing some imaginary CMO don’t help you write better emails or build better targeting. It’s just a shared illusion that the whole team knows the customer.

The problem compounds when teams treat personas as fixed. Real buyers don’t fit neatly into archetypes. One technical founder evaluating your product thinks differently from a non-technical CEO, even if both carry the same title. A first-time VP has different needs compared to someone who has held that position at three previous companies.

Use personas as starting points, not as destinations. Continuously refine them with data from real deals: win/loss interviews, sales call recordings, and closed-won analysis. It’s not about a perfect persona document; it is an ongoing understanding of your buyers that gets better with every passing day as you learn more about who actually buys and why.

Final Thoughts: Why B2B Demographic Data Is Key to Smarter Targeting

It’s easy enough to gather demographic information. It’s quite a different thing altogether to maintain it as up-to-date, detailed, and actionable. “Most teams are still working with out-of-date job titles, missing seniority data, and incomplete buying profiles and it’s hurting them on opportunities they don’t even know they’re losing.”

AI Ark assists B2B sales and marketing teams in enhancing contact information with verified demographic information, including job titles, seniority, departments, skills, and more about your connections. No more guessing who controls budgets. No more pointless outreach to people who switched roles half a year ago. Just clean and up-to-date information to communicate with the right people at the right time.

Why build on uncertain data when you can target more effectively?

Book a Demo with AI Ark today and discover for yourself how precise demographic information can revolutionize your prospecting efforts, refine your targeting, and enable you to make more closings.

FAQs About B2B Demographic Data

1. What is B2B demographic data?

B2B demographic data is people-level information about professionals inside a company, like job title, seniority, department, skills, and location, used to target the right decision-makers, not just the right accounts.

2. What’s the difference between B2B demographic data and firmographic data?

Firmographics describe the company (industry, size, revenue, location). Demographics describe the person (title, seniority, department, skills). Firmographics help you pick the right accounts; demographics help you reach the right buyers inside them.

3. What B2B demographic data points matter most for targeting?

The most useful targeting fields in terms of qualification are:

- Job title + seniority (level of authority)

- Department / Function (Relevance to the Role)

- Technical fit would (skills/certifications)

- Location + timezone (timing/territory Language preferences, Localization, and trust)

4. How do you collect B2B demographic data?

You can source B2B demographic data from:

- First-party forms (highest accuracy)

- LinkedIn signals (often most up to date)

- CRM enrichment tools offer the best method for scale.

- Visitor/intent tools: help in spotting active interest.

- Manual research is best for high-value accounts

The strongest way is through sources combining and refreshed titles/seniority.

5. How does B2B demographic data improve targeting and conversions?

It enhances your outcomes as it aids in quick qualification, personalized outreach, and reaching buying committees (the economic buyer, technical reviewer, actual user, and sponsor). When your demographic fields are set properly, your ads and outreach efforts target the correct roles, and as a result, you waste less budget and generate more qualified conversations. Solutions such as AI Ark assist with this.