Reaching out to a prospect cold, without knowledge of their tech stack, is the same as walking into a sales meeting blindfolded. You have no idea if they are on your competitor’s solution, whether they have budget allocated for a tool like yours, or even if the current infrastructure supports what you’re selling. The result? Wasted outreach, lower response rates, and deals that stall before they start.

This is where technographic data changes the game. Providers of B2B technographic data are organizations that collect information on the technology stacks of businesses in use, including software, tools, and IT infrastructure, and vend them to sales and marketing teams to better target prospects.

By 2026, no one is going to be able to rely on technographic intelligence as an option. Powered by AI-based sales devices and the necessity to be personalized on a large scale, understanding what your prospects are already doing with technology is the difference between a cold pitch and an engaged discussion. Equipped with technographic data, sales teams are targeting better-fit accounts, crafting resonant messaging, and shortening their sales cycles.

In this guide, we have compared 10 of the best B2B technographic data providers, honestly. We considered data accuracy, technology coverage, pricing transparency, integrations, and ease of use to find the right fit for your team.

What Is a B2B Technographic Data Provider?

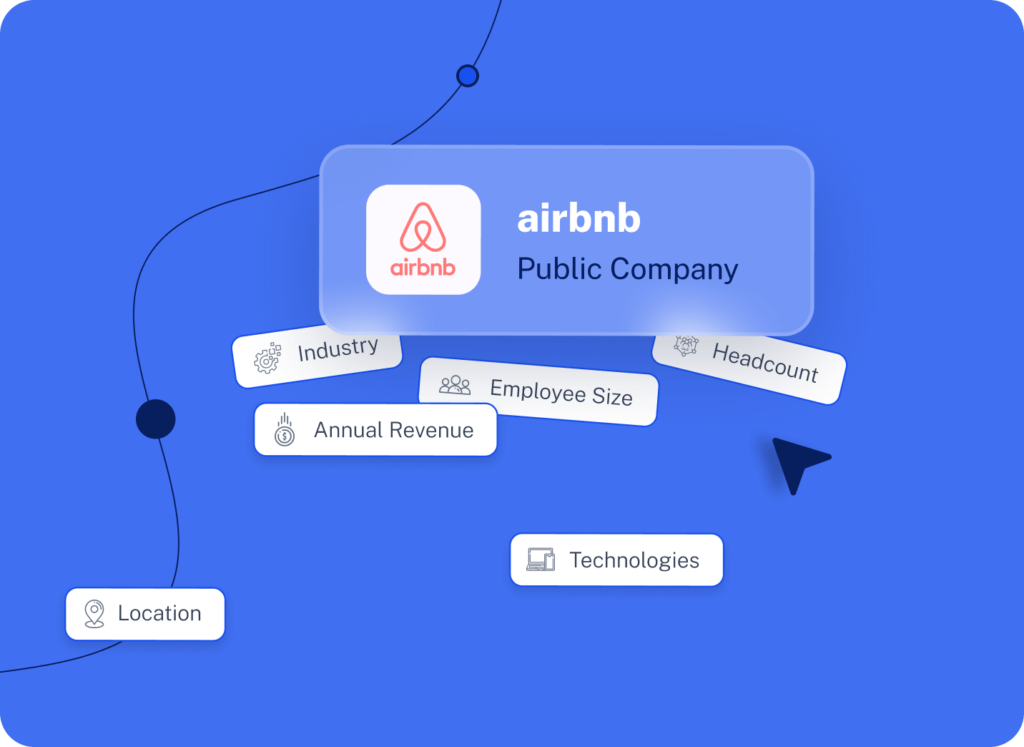

A B2B technographic data provider gathers, verifies, and then sells data about which technologies businesses use. These include, but are not limited to: software applications, SaaS subscriptions, cloud infrastructure, hardware deployments, and IT spending patterns.

This data informs sales teams, marketing departments, RevOps, SDRs, and ABM strategists on how to identify high-fit accounts through personalized outreach and lead prioritization based on technology compatibility.

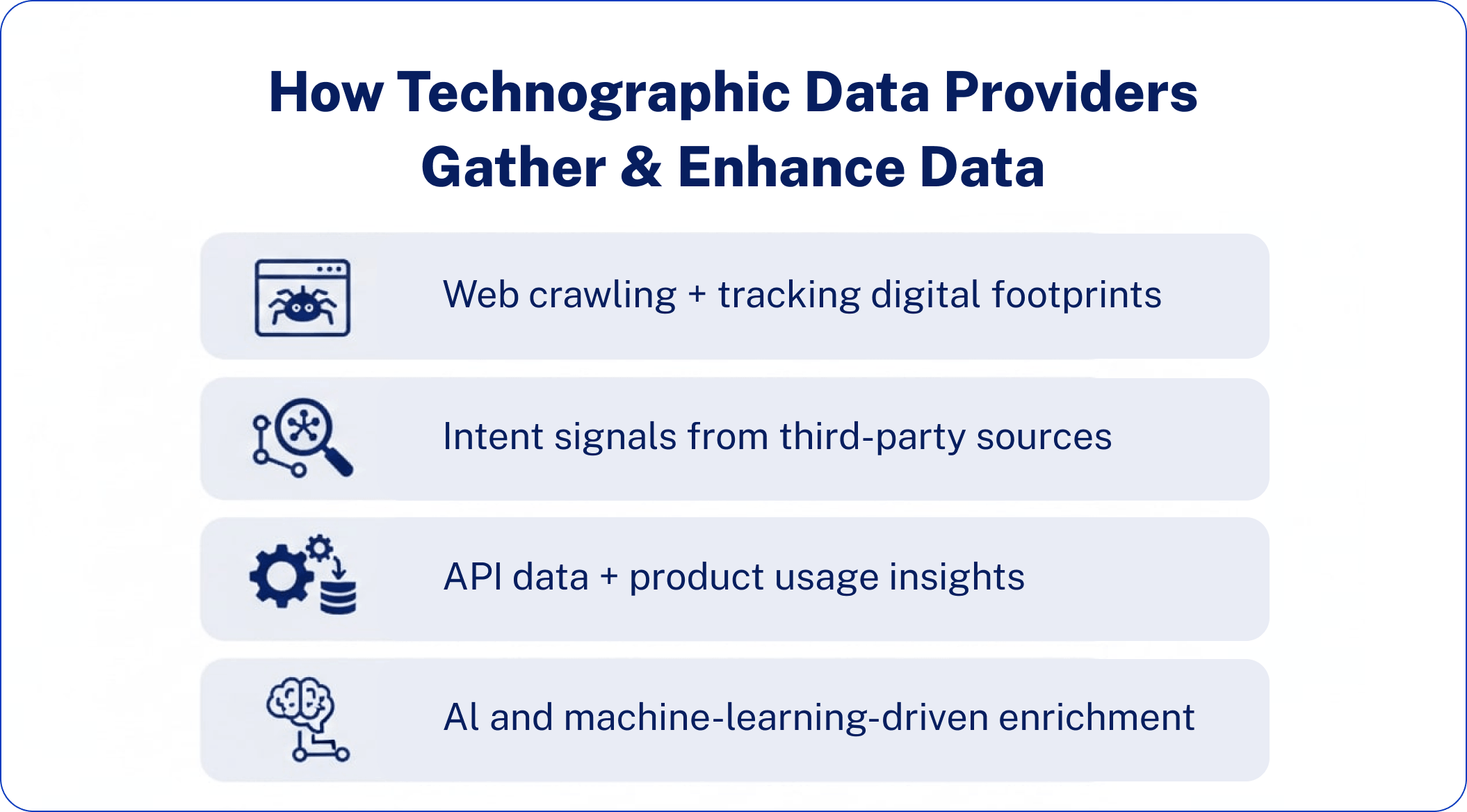

How Technographic Data Providers Collect and Enrich Data

Ever wonder how these providers know what tech stack a company is using? Not magic, but rather multiple methods of collecting data, each with its strengths and limitations.

Knowing how this information is gathered aids in assessing which vendors provide good intelligence versus those that are simply guessing.

Web Crawling and Digital Footprint Analysis

This is the basis for most technographic databases. Vendors set up crawlers that scan millions of websites looking for technology signals that may be hidden in plain sight:

- Tracking pixels and scripts: Systems such as Google Analytics, Facebook Pixel, or Hotjar deposit snippets of code that can be detected.

- Meta tags and headers: CMS platforms, web hosting companies, and security providers disclose infrastructure selection.

- Job postings: A company that is seeking to recruit a “Salesforce Administrator” or AWS DevOps Engineer indicates that they are stack.

- Public Filings & Press Releases: Announcing partnerships, integrations, and technology releases can be checked as verifiable data.

The limitation? Front-end technologies are the only ones that are captured by web crawling. When applied as a single technique, it is blind to back-end systems, internal tools, and programs that run behind firewalls.

Intent Signals and Third-Party Data

Technographic providers don’t just track what companies use but also monitor what companies are researching. Intent data adds a layer of timing and buying signals:

- Content consumption patterns: monitor which whitepapers, comparison guides, and product pages prospects are interacting with.

- Ad interactions: tracking clicks on software-related ads across the web

- Review website activity: identify when companies research solutions on your G2, Capterra, or TrustRadius profiles.

- Search behavior: Identifying spikes in queries about certain tools or categories

This helps you find prospects that are actually evaluating solutions, not just passively using their current stack.

API Integrations and Product Usage Indicators

Some providers go beyond surface-level detection by pulling data directly from connected platforms:

- Integrating CRM with marketing automation: enriching existing records by syncing directly with Salesforce, HubSpot, or Marketo.

- Vendor partnerships: Working with software companies for access to anonymized usage data.

- Cloud marketplace signals: Tracking deployments via AWS, Azure, or Google Cloud ecosystems

This method is more accurate since active use is counted; it is not just the installed code is present.

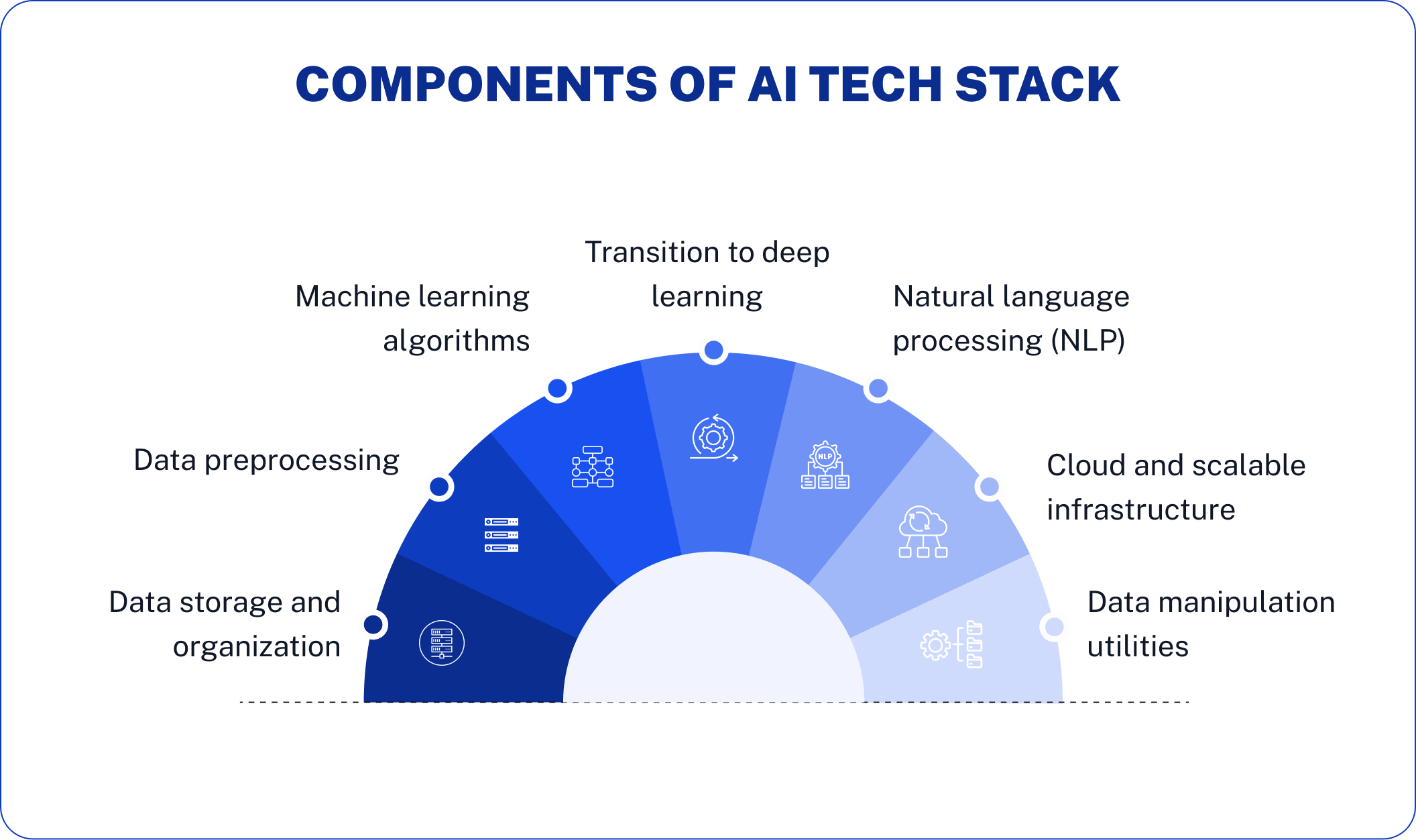

AI and Machine Learning Models

In the absence of direct signals, the providers fill in the gaps by the use of predictive intelligence:

- Peer analysis: This involves the inference of probable technology usage based on what companies of similar size and in the same industry use.

- Pattern recognition in hiring: Using recruitment trends to forecast technology adoption

- Signals of cloud marketplaces: Monitoring the deployments using AWS, Azure, or Google Cloud ecosystems.

The methodology is more accurate since active use is recorded as opposed to having installed code.

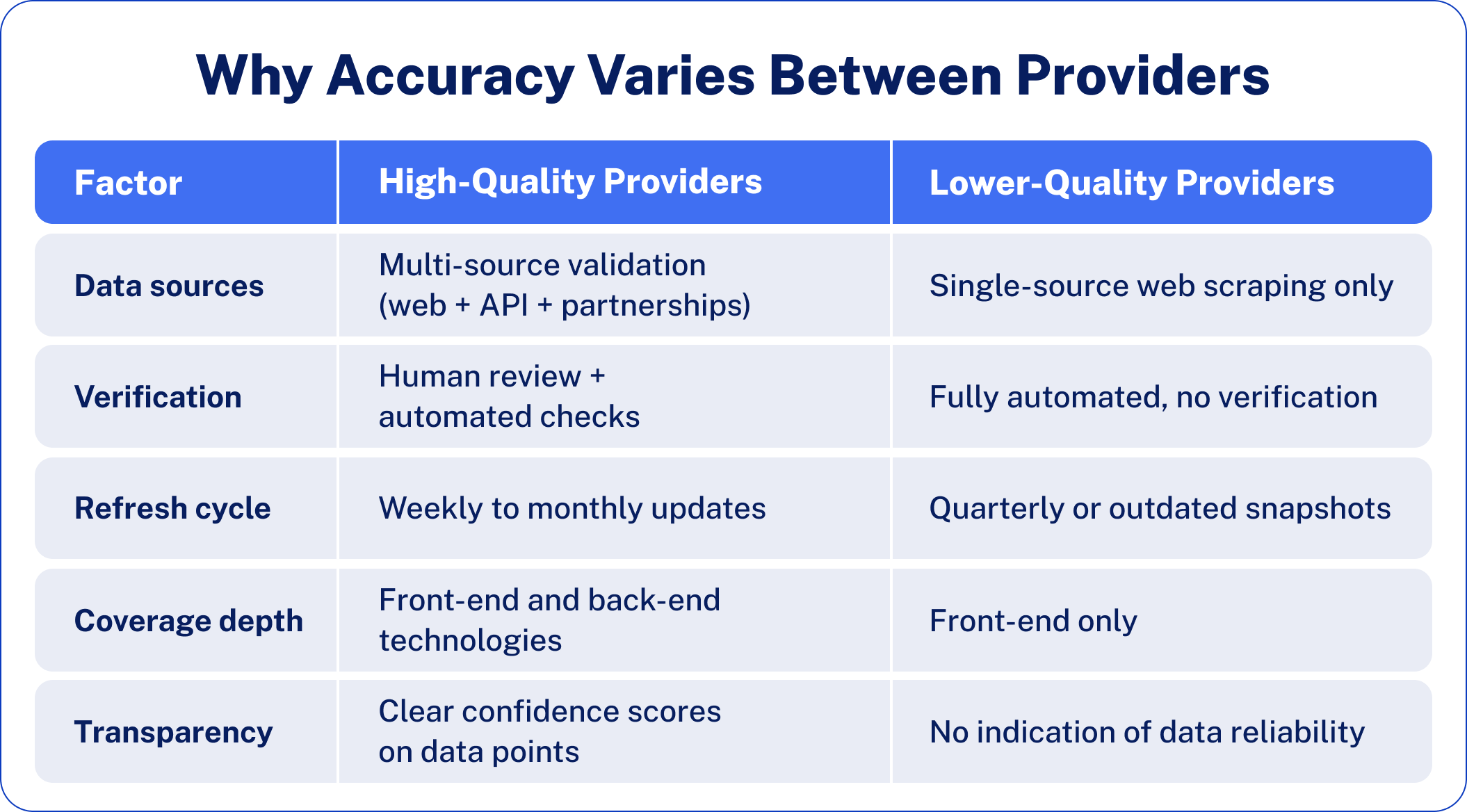

Why Accuracy Varies Between Providers

Not all technographic data is created equal, and this gap in quality comes down to methodology and investment.

The difference shows up in your results. Reliable technographic data means fewer bounced emails, more relevant conversations, and higher conversion rates. Poor data means wasted outreach and frustrated sales teams.

When evaluating providers, a good question to always ask is: How do you collect this data, and how often is it refreshed?

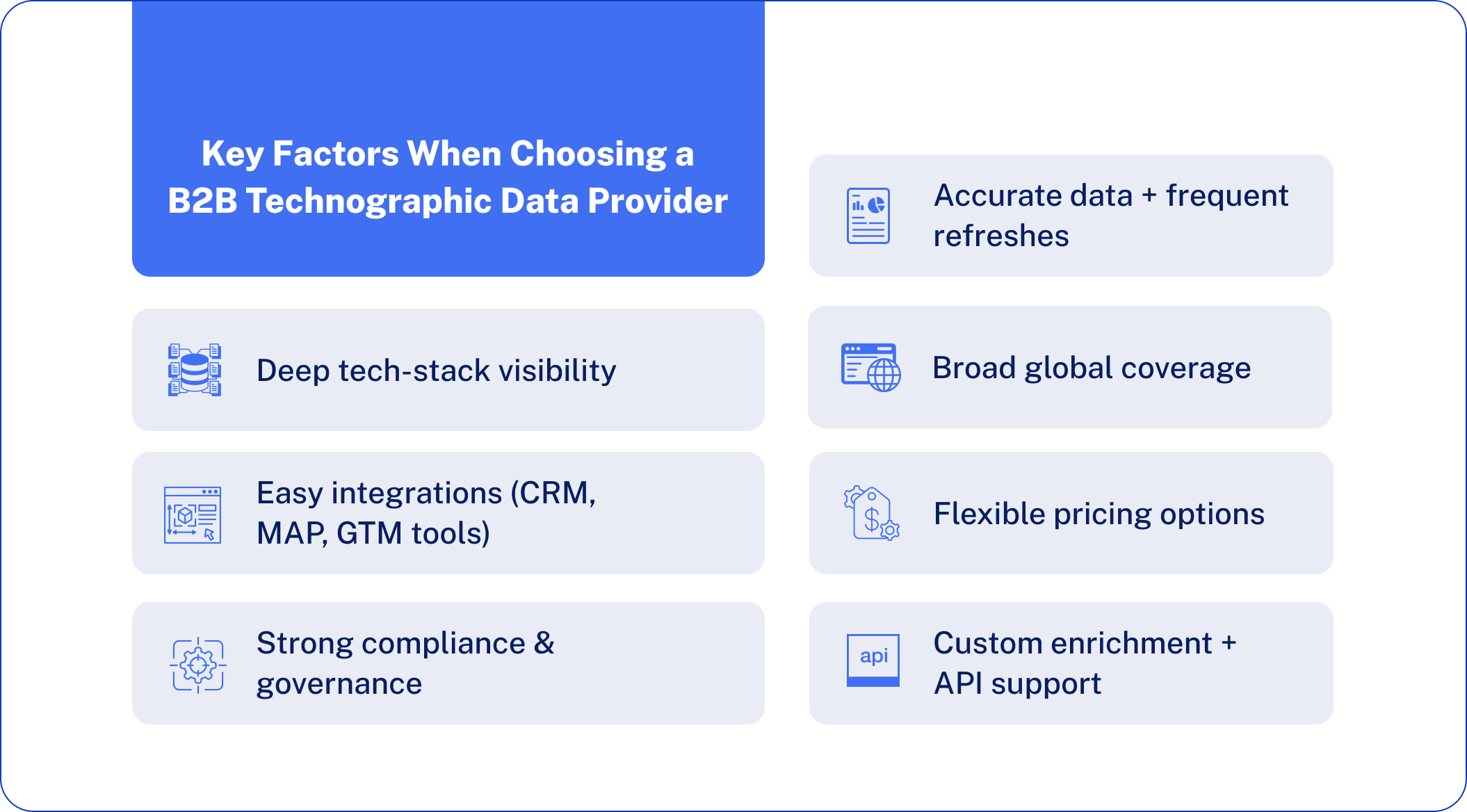

Key Factors to Consider When Choosing a B2B Technographic Data Provider

Not every technographic data provider is a good fit for your team. The right choice depends on the use case you have in mind, your budget, tech stack, and target market.

Before you commit to a platform-or worse, sign a 12-month contract you’ll regret-evaluate providers against these seven critical factors.

1. Data Accuracy and Refresh Rate

Accuracy is everything. Technographic data decays fast because companies are constantly adopting new tools, switching vendors, and sunsetting legacy systems. A database that was accurate six months ago could very well be misleading today.

Questions to ask:

- What is the reported accuracy rate, and how is it measured?

- How often is the data refreshed on a weekly, monthly, or quarterly basis?

- Does the provider differentiate between verified data and inferred data?

- What process would be used to flag or correct outdated records?

What to look for:

- Refresh cycles of 30 days or less

- Multi-source verification, not just web scraping

- Confidence scores or accuracy indicators on individual data points

Red flag: Providers who cannot clearly explain their verification methodology or who make claims of “real-time” accuracy without evidence.

2. Global Coverage

In case your target market cuts across several areas, then so does your provider. Most of these platforms are US-based and have a low presence in the European, Asian Pacific, or emerging markets.

Questions to ask:

- What is the number of companies and contacts that fall under my target regions?

- Does the data quality differ across geographies, or is it strong in specific markets?

- Are there any industry or company size gaps?

What to look for:

- Explicit coverage numbers by region, not just global totals

- Strong presence in your priority markets, be it North America, EMEA, APAC, or LATAM

- Consistent depth of technographic insights across regions, not just contact data

Red flag: Providers quoting massive global databases but unable to break down coverage by region or industry.

3. Depth of Tech Stack Insights

Surface-level data tells you a company uses Salesforce. Deep technographic intelligence tells you which Salesforce products they’ve deployed, how long they’ve used them, and what complementary tools they’ve integrated.

Questions to ask:

- What is the number of technologies that the platform tracks?

- Does it have front-end or visible technologies and back-end infrastructure?

- Do we have adoption schedules, usage rates, or renewals of the contract?

- Does it have estimates of spending or budget indicators?

What to look for:

- Coverage of 10,000+ technologies across categories: CRM, marketing automation, cloud, security, analytics, etc.

- Visibility into tech stack changes over time, rather than just current snapshots.

- IT spend or budget data for enterprise targeting.

Red flag: Providers that only find basic web technologies like CMS platforms and analytics tags but miss deeper SaaS and infrastructure insights.

4. Integration Ecosystem

The data you have on the technographics will not be useful unless it is fed into tools that your team operates. An integrator that is less integrated forms silos of work and data.

Questions to ask:

- Is it connected to my CRM, i.e., Salesforce, HubSpot, or Pipedrive?

- Is it compatible with other marketing automation systems such as Marketo, Pardot, and ActiveCampaign?

- Does it have pre-integrated sales engagement software, Outreach, Salesloft, and Apollo connectors?

- Does it have an adaptable API for workflow customization?

What to look for:

- In-app integrations with your own GTM stack.

- Two-way syncing (not one-way exports only)

- Live or periodic data enhancement in your CRM.

- Custom automation support (Zapier or webhook).

Red flag: It is also only the CSV export that is offered by providers, or the basic integrations must be costly to build.

5. Pricing and Flexibility

Pricing Technographic data is highly non-transparent; most vendors put prices behind the contact sales buttons and tie you to incomplete flexibility annual contracts.

Questions to ask:

- Does it have transparent pricing, or do I call in to make a sales call to obtain a quote?

- What are the base plan features, and which of them are add-ons?

- Do they have credit limits, and what happens should I go beyond them?

- Is it possible to have a monthly or trial plan before committing to an annual plan?

- What’s the renewal policy?

- Are the prices automatically increased?

What to look for:

- Well-defined pricing levels are posted on the website.

- Plans that grow with your usage.

- Pilot project or free trials to check on data quality before buying.

- None of the secret charges on options such as intent data, technographics, or API access.

Red flag: Providers that have a minimum 12-month term with no trial, or that charge individually for every feature of an advanced nature.

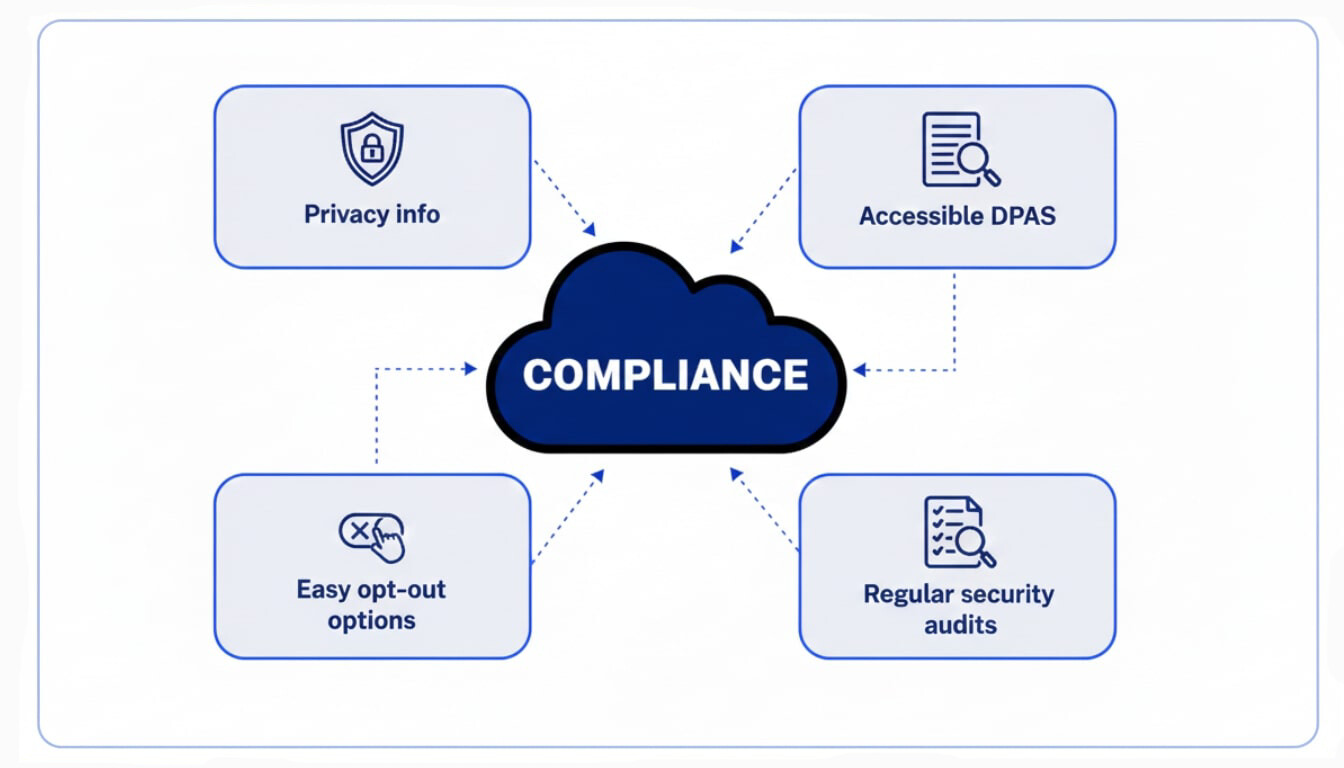

6. Compliance and Data Governance

The regulations of data privacy are not coming to a halt. Your data sources must be ethical and transparent according to GDPR, CCPA, and others.

Questions to ask:

- Does the provider comply with the GDPR and CCPA?

- What is the source of the data, and has consent been received where necessary?

- Does the platform provide the data subjects with opt-outs?

- Does it have SOC 2 or ISO 27001 certifications on data security?

What to look for:

- Clearly document compliance and privacy policies

- Published data processing agreements (DPAs)

- Easy-to-find opt-out pages for both individuals and companies

- Regular third-party security audits

Red flag: Providers who cannot specify sources of data or fail to provide compliance documents if requested.

7. Custom Enrichment and API Capabilities

Although out-of-the-box features can usually be effective in most teams, more often than not, growing organizations require the ability to develop their own workflows and enrich data at scale.

Questions to ask:

- Does the provider have a robust API for custom integrations?

- Can I add to my current database in large volume, or can I search and find new contacts?

- Are the rates capped, or do they have any extra charges to the API?

- Is it possible to create custom scoring models or filters using technographic attributes?

What to look for:

- REST API is well-documented and has clear endpoints

- Bulk enrichment of existing CRM/marketing list

- Custom search query parameters are allowed

- Testing environment or developer support

Red flag: Providers whose API is an afterthought, poorly documented, rate-limited, or priced prohibitively.

The “best” provider depends on what your team prioritizes. A startup running lean ABM campaigns has different needs than an enterprise RevOps team building a global enrichment pipeline.

Take these seven factors as your checklist, and don’t overlook the trial period.

Top 10 B2B Technographic Data Providers in 2026

Now that you know what to look for, let’s dive into the providers leading the market in 2026. We’ve evaluated each of these platforms based on data accuracy, technographic depth, integrations, pricing transparency, and overall fit for various sizes of teams and use cases.

Each of the providers below has information in the same format, so you can easily compare them and choose one that best fits your needs.

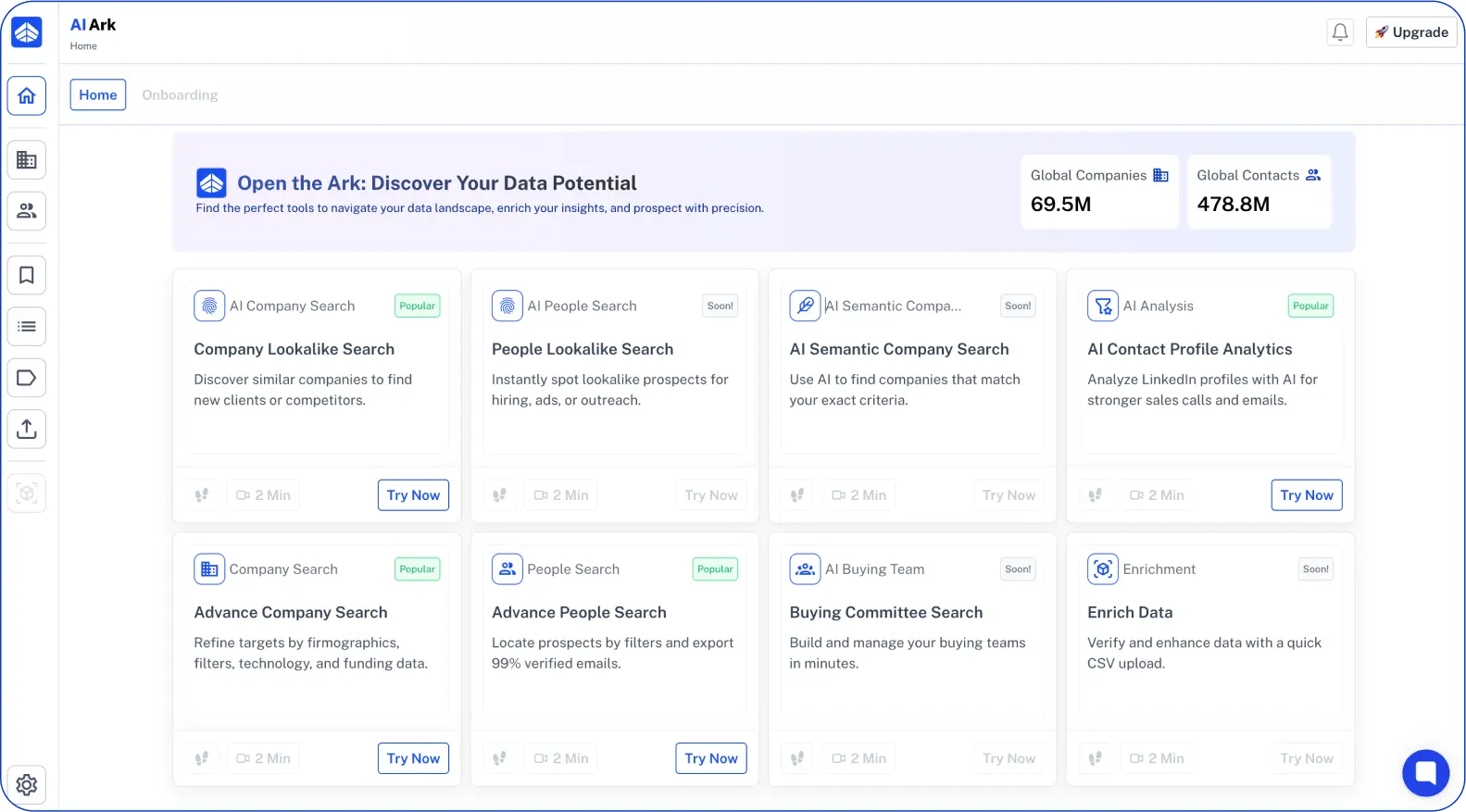

1. AI Ark

AI Ark is a B2B data platform powered by AI, differentiated by deep AI integration, built from ground zero. Unlike rivals, who retrofitted AI on top of a basic data system, AI Ark integrates advanced AI from the ground up. Their deep AI integration can precisely collect, analyze, normalize, and organize the data; thus, powering distinctive features such as Lookalike Search.

The platform uses the most advanced AI technology to boost data discovery and segmentation, ensuring precise insights with detailed firmographics and technographics. AI-Ark boasts that it provides a 95%+ ICP match with lookalike search and is able to reach 30-50% more targets with valid catch-all emails.

Key Features

- AI Lookalike Search

- AI Semantic Search

- People Data & Company Profiles

- 30-day data refresh cycle

- Built-in technographic filtering

Coverage

- EMEA (Europe, Middle East, Africa)

- NAM (North America)

- APAC (Asia Pacific, including Asia, Australia, Oceania)

Compliance

- Fully GDPR compliant

Pricing

- Pricing based on credits

- Monthly and annual options available

- Free trial with 100 credits

- Custom enterprise plans available

- 500M+ Companies and People with high-density data.

- Data refreshes on a monthly cycle, ensuring high freshness.

- Strong focus on API accessibility over regional breakdown.

2. ZoomInfo

Serving over 30,000 companies globally, this provider is a market leader in cutting-edge go-to-market software, data, and intelligence.

ZoomInfo, one of the largest B2B intelligence platforms on the market, is a leading provider of go-to-market software, data, and intelligence. It currently serves over 30,000 companies globally.

The platform boasts more than 321 million contacts, 104 million companies, and other key data points, including direct-dial phone numbers, verified mobile numbers, email addresses, organizational charts, and company technographics.

Technographic Capabilities

- Traces more than 300 million pairings between companies and technologies

- Tracks over 30,000 technologies

- Covers 200+ technology categories

- Nearly 90% of tech-to-company pairings have been updated within the past three months.

Coverage

- US-centric database, data quality is normally superior to that of American contacts as compared to international markets.

- European or Asia-based teams can develop gaps.

Compliance

- GDPR and CCPA compliant

Pricing

- Advanced Plan: $24,995/year

- Elite Plan: $39,995/year

- Credit-based system

- Annual contracts that are mandatory (no monthly)

3. Demandbase

Demandbase is a foundational company in B2B marketing tech, based in San Francisco since 2007, and they were really instrumental in helping define the modern account-based marketing category.

Demandbase has been recognized as a Leader in the 2025 Gartner® Magic Quadrant™ for Account-Based Marketing Platforms for its fifth consecutive year.

Technographic Capabilities

- Covers 21K+ technologies

- Integrates firmographic, technographic, and intent data.

- Technological visibility of the tech stack at the account level.

Advertising Capabilities

- Native Demand-side Platform (DSP) developed to serve B2B ABM.

- Multi-channel ad campaign management. Video, social, and display

- Account-based advertising.

Integrations

- Salesforce (primary)

- Marketo, Pardot, Eloqua

- HubSpot, Microsoft Dynamics

Pricing

- Custom enterprise-level pricing

- Annual contracts required

- Onboarding fees apply

- Pricing not publicly disclosed

4. Apollo.io

Apollo.io offers B2B data intelligence combined with sales engagement in one platform. Apollo is a $1.6B AI-powered sales platform that helps revenue teams find and engage leads, automate outreach, manage deals, and enrich data in one place.

Apollo’s B2B Database offers over 210 million contacts and 35 million companies with high-quality, accurate data. Apollo has developed a very strong database due to its large network of more than 2 million data contributors.

- Includes verified emails, direct-dial phone numbers, firmographic details, and technographic data

- Enrichment tools automatically fill in missing firmographics and technographics

- Technology stack filtering in prospecting workflows

Key Features

- Built-in email sequencing

- Dialer for calls

- CRM functionality

- Chrome extension for LinkedIn

Compliance

- GDPR, CCPA, and SOC 2 compliant

Pricing

- Free plan available

- Plus Plan: $149/month (annual) or $199/month (monthly)

- Professional and Organization plans available

- Credit-based system

5. SimilarWeb

Web traffic and competitive intelligence are what Similarweb is known for, although it has grown to include sales intelligence with technographic capabilities. Users can filter through over 20.3 million online businesses using more than 100 precision filters.

Technographics enables you to generate leads and qualify prospects depending on the technologies they have installed at their site.

Technographic Capabilities

- Technology detection across websites

- Combines tech data with website traffic and engagement insights

- Firmographic and technographic details in one view

AI Features

- AI Prospecting: turns natural language prompts into lead lists

- AI Outreach: personalized sales messaging

Key Differentiator

Similarweb is one of the few that uses technographics alongside analytics of traffic to the site and competitiveness, which pure data providers do not provide.

Pricing

- Sales Intelligence: $129/month (or $1200/annually)

- Free trials available

- Enterprise features would demand a custom price.

6. HG Insights

HG Insights specializes in enterprise-grade technographic data with a unique focus on IT spend intelligence, something most competitors don’t offer.

HG Insights provides best-in-class technographics, offering access to the world’s most granular, in-depth view of the IT landscape. Its behind-the-firewall technology detection finds and evaluates the hardest products to detect.

Technographic Capabilities

- 120+ million confirmed technology installations.

- Solutions, services, and products 14,000+ tracked.

- 2 billion weekly intent signals.

- Behind-the-firewall technology recognition

IT Spend Intelligence (Unique Feature)

- Categorical spend forecasting of 140+.

- Hardware, software, services, and communications.

- 12-month spending predictions

Best For

- Enterprise sales into IT/technology departments

- Strategic account planning

- Competitive displacement campaigns

- Market sizing by IT spend

Pricing

- $12,000 to $90,000 annually

- Custom enterprise contracts

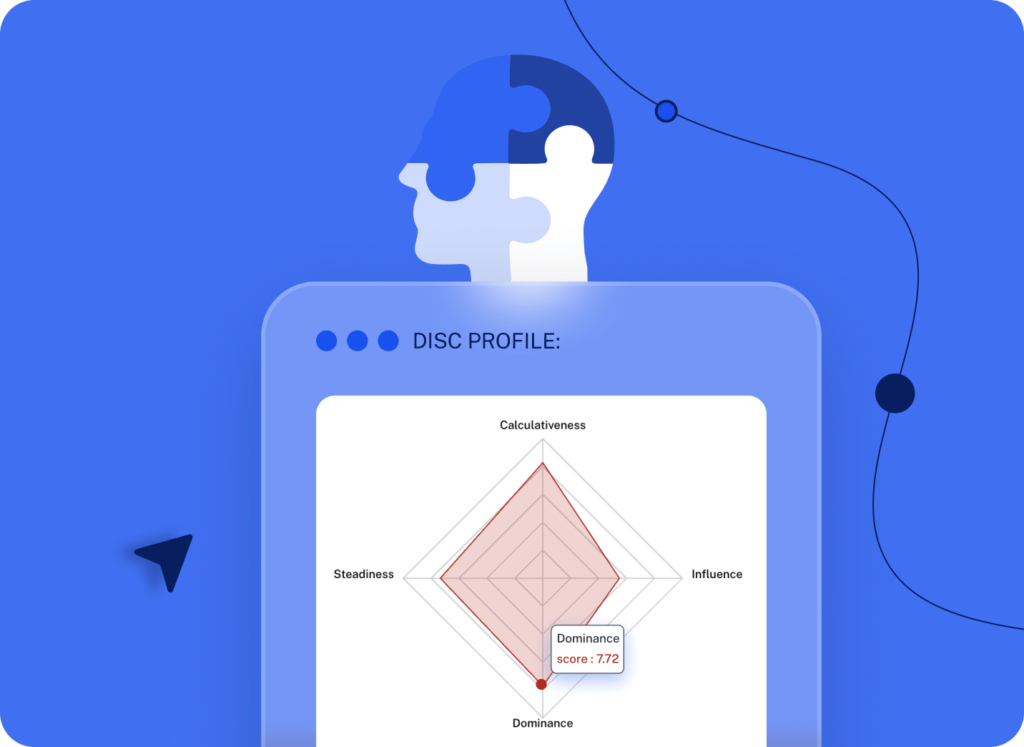

7. 6sense

6sense is the first agent-powered Revenue Intelligence platform. It’s a platform focused on accounts showing buying intent before they identify themselves. For the fifth year in a row, 6sense was named a Leader in the 2025 Gartner® Magic Quadrant™ for Account-Based Marketing Platforms.

Every day, 6sense Signalverse™ captures one trillion signals, which are intent, company, and contact data, to fuel AI that pinpoints who’s ready to buy, how to engage them, and when to act.

Technographic Capabilities

- Market-leading technographic data from Slintel (a 6sense company)

- Persona, technographics, and psychographics data

- Web visitor identification

Data Freshness

- Intent signals updated in near real-time (within 24 hours)

- Firmographic and technographic data are refreshed on a continuous rolling basis

Pricing

- Free plan with limited credits available

- Paid plans: $60,000 to $100,000/year for most companies

- Median buyer pays $55,211/year (per Vendr data)

8. SalesIntel

SalesIntel is the only pipeline generation platform bringing together AI, human-verified B2B data, real-time intent signals, and agentic workflows in one place.

What really sets the platform apart, however, is human-verified data. More than 95% of contact data gets re-verified every 90 days for accuracy by researchers.

Database & Coverage

- 95% data accuracy

- 54M+ verified mobile numbers

- 90-day refresh cycle

Technographic Capabilities

- 16,500+ unique technology products

- 22M companies covered

- 225M+ technographic data points

Unique Features

- Research-on-Demand (RoD): order individually research and validated custom contact lists.

- Infinite enrichment credit on certain plans.

- Bombora-powered intent data

Best For

- Teams prioritizing accuracy over database size

- Organizations needing custom research for niche contacts

- Mid-market companies wanting human-verified data

Pricing

- Team-based custom pricing.

- No limit on the available access tiers.

- Annual contracts standard

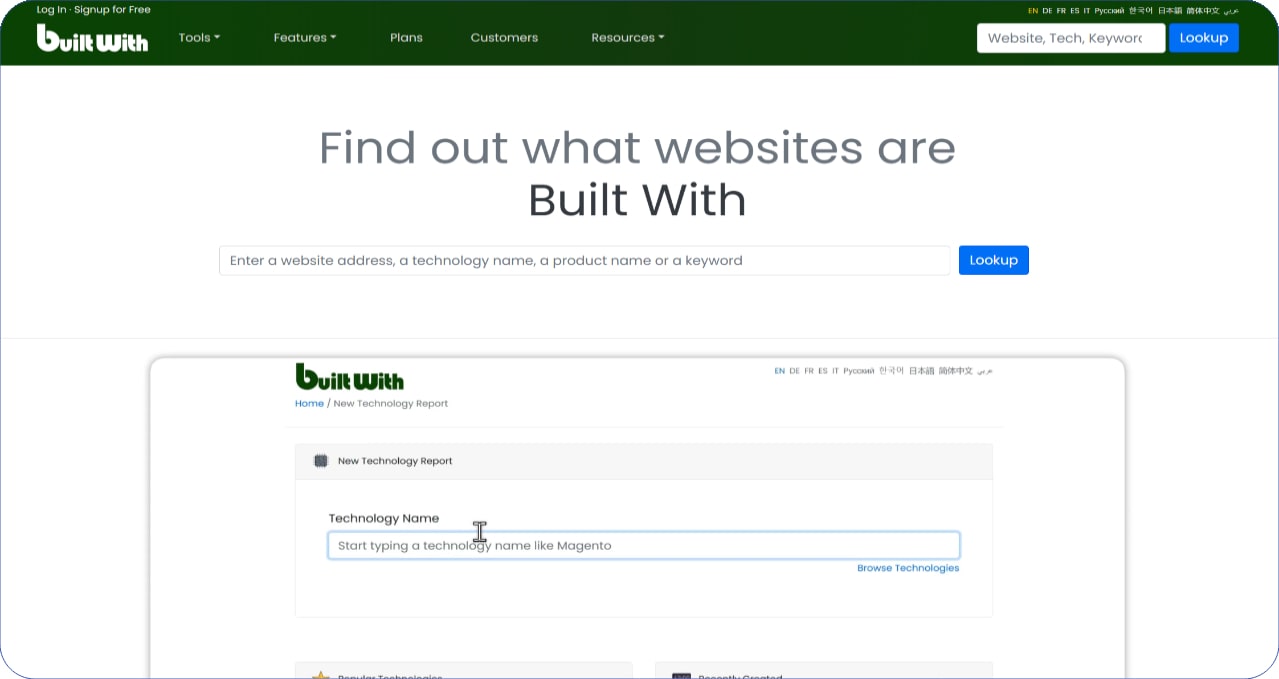

9. BuiltWith

BuiltWith is the original technographic data pioneer, founded in 2007 as the first web technology profiler available in the market. While other solutions offer technographic data as part of their larger B2B data offerings, BuiltWith is purely a technology stack detection solution and does it more accurately than any other solution on the market. The solution is constantly web crawling and indexing technologies used on websites, from frontend analytics and CMS solutions to backend infrastructure solutions.

Technographic Capabilities

- Total tech tracked: 109,851+

- Technology detection for analytics, advertising, hosting, CMS, eCommerce, and other areas

- Data regarding 18+ years of technology adoption and trends (from 1985 until today)

- 2,500+ eCommerce platforms tracked on 26 million eCommerce sites

- Technology trends and market share analysis

Key Features

- Technology Lookup: Immediate technological stack analysis of a website

- Lead Generation Lists: Build Lists Based on Specific Technology Use

- Predictive Leads: Predictive Leads: Predictive Leads: Predictive Leads: Predictive Leads: Predictive

- Competitive Analysis: technologies can be compared and migration rates between technologies can also be checked

- Website Spend Data: Data on how much websites spend on web technologies

- CRM Integrations: Salesforce, Hubspot, Zoho CRM, Microsoft Dynamics 365 Business

Coverage

- 414M+ domains are

- Billions of Web Pages Tracked

- Worldwide presence in all regions

- Updates of data on a weekly basis

Compliance

- GDPR compliant

- Contact information exported under the GDPR provisions

Pricing

- Free: Personal website searches, always free

- Basic: $295/month (2 technologies, 2 keywords, 2 retail reports)

- Pro: $495/month (Unlimited use of all technology, keywords,

- Team: $995 per month (Unlimited access + unlimited logins)

- Annual discounts available

- Cancel anytime

10. SMARTe

SMARTe is a sales intelligence platform that provides B2B sales teams with global, accurate company and contact data; founded in 2005. This platform boasts strong international coverage, especially in the EMEA and APAC regions.

With two decades of expertise in data quality and global compliance, SMARTe offers a comprehensive database featuring over 281 million contacts and 65 million companies. This ensures users receive accurate, complete, and trustworthy data.

Technographic Capabilities

- 50,000+ technologies tracked

- Signals for management changes, funding rounds, and technographics

- Intelligence from job postings, blogs, and websites

Global Coverage

- North America, EMEA, APAC, and LATAM

- 70% mobile availability in North America

- 50% mobile availability across EMEA, APAC, and LATAM

Compliance

- SOC 2 Type II certified

- GDPR and CCPA compliant

Pricing

- Free: 10 credits/month (no card needed)

- Pro: $25/month for 50 credits

- Enterprise: Starting from $15,000

- No user license fees, unlimited users

Comparison Table: Top 10 Technographic Data Providers

Selecting an appropriate provider of technographic data depends on the size of the team, budget, geographic focus, and planned usage. While some platforms provide enterprises with the capability for predictive intelligence in ABM, others are popular as cost-effective all-in-one solutions targeting startups and growing sales teams.

The table below compares the top 10 providers against the factors that matter most: who they’re best suited for, how many technologies they track, pricing, and what makes each one unique. Make use of this quick reference to narrow down your shortlist before diving deeper into individual reviews.

| Provider | Best For | Technologies Tracked | Starting Price | Key Differentiator |

| AI-Ark | SMBs & B2B agencies | Built-in technographics | Free trial | AI Lookalike Search |

| B2B Enrichment | API Builders & Value Focus | Included in 250+ data points | $99/month | Transparent, API-first pricing model |

| ZoomInfo | US enterprise teams | 30,000+ | $25,000/year | Largest US database |

| Demandbase | Enterprise ABM | 21,000+ | Custom | Native B2B ad platform |

| Apollo.io | Startups & SMBs | Thousands | Free | All-in-one sales platform |

| Similarweb | Traffic + tech insights | Web technologies | $129/month | Traffic analytics included |

| HG Insights | IT sales & market sizing | 14,000+ | $12,000/year | IT spend forecasting |

| 6sense | Predictive ABM | Via Slintel | $55,000/year | Intent + buying stage AI |

| SalesIntel | Data accuracy focus | 16,500+ | Custom | Human-verified contacts |

| SMARTe | Global sales (EMEA/APAC) | 50,000+ | $25/month | Best international coverage |

How to Use Technographic Data Effectively

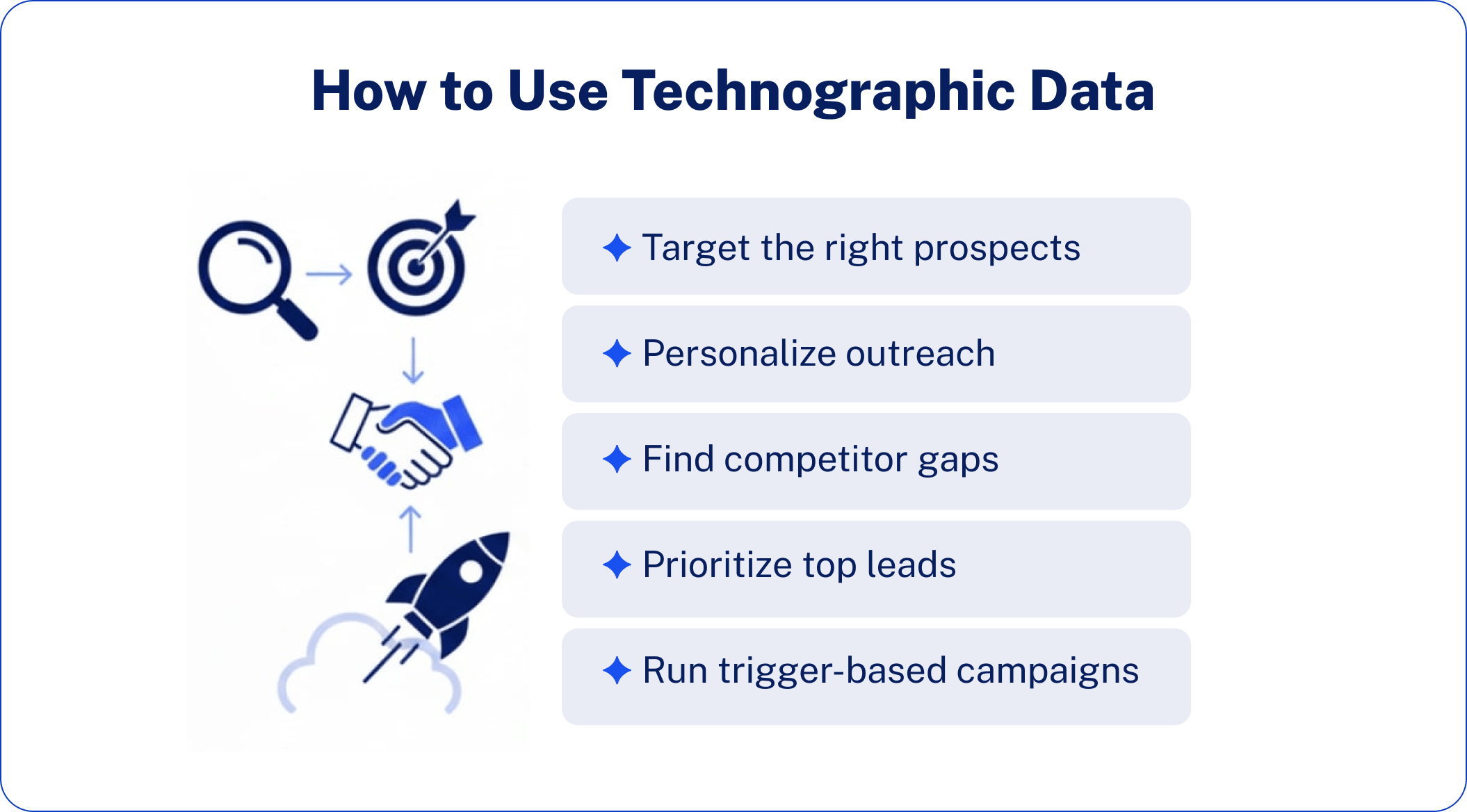

The collection of the technographic information is just the beginning. The actual worth lies in what you put into the sales and marketing processes. When used in an effective way, technographic knowledge may transform a generic reach into highly specific campaigns that vibe with potential buyers and lead to conversion.

Here are five proven ways to put technographic data to work:

- Build targeted prospect lists:

Filter out companies based on the technologies they employ to build laser-focused lists that perfectly suit your ideal customer profile. Target the companies that are already using Salesforce if your product integrates with it. If you compete with HubSpot, find the businesses running that particular platform. - Personalize cold outreach:

Generic emails are ignored. Knowing what tools a prospect uses enables you to reference their tech stack directly and position your solution as one that fits naturally, increasing response rates dramatically. - Discover opportunities to displace competitors:

Look for companies that are using your competitors’ products and create messaging that appeals to known pain points or limitations. This is one of the highest-converting uses of technographic data. - Score and prioritize leads:

Combine technographic insights with firmographic and intent data to enable smarter lead scoring models. Prospects using complementary technologies tend to convert faster. - Execute trigger-based campaigns:

Set notifications when your target accounts start using new technologies, secure funding, or hire key employees; these are the signals that indicate buying readiness and create perfect outreach moments.

The bottom line? Technographic data helps you reach the right companies with the right message at the right time. Whether you are building prospect lists, running ABM campaigns, or prioritizing your pipeline, knowing your prospects’ tech stack gives you a significant competitive edge.

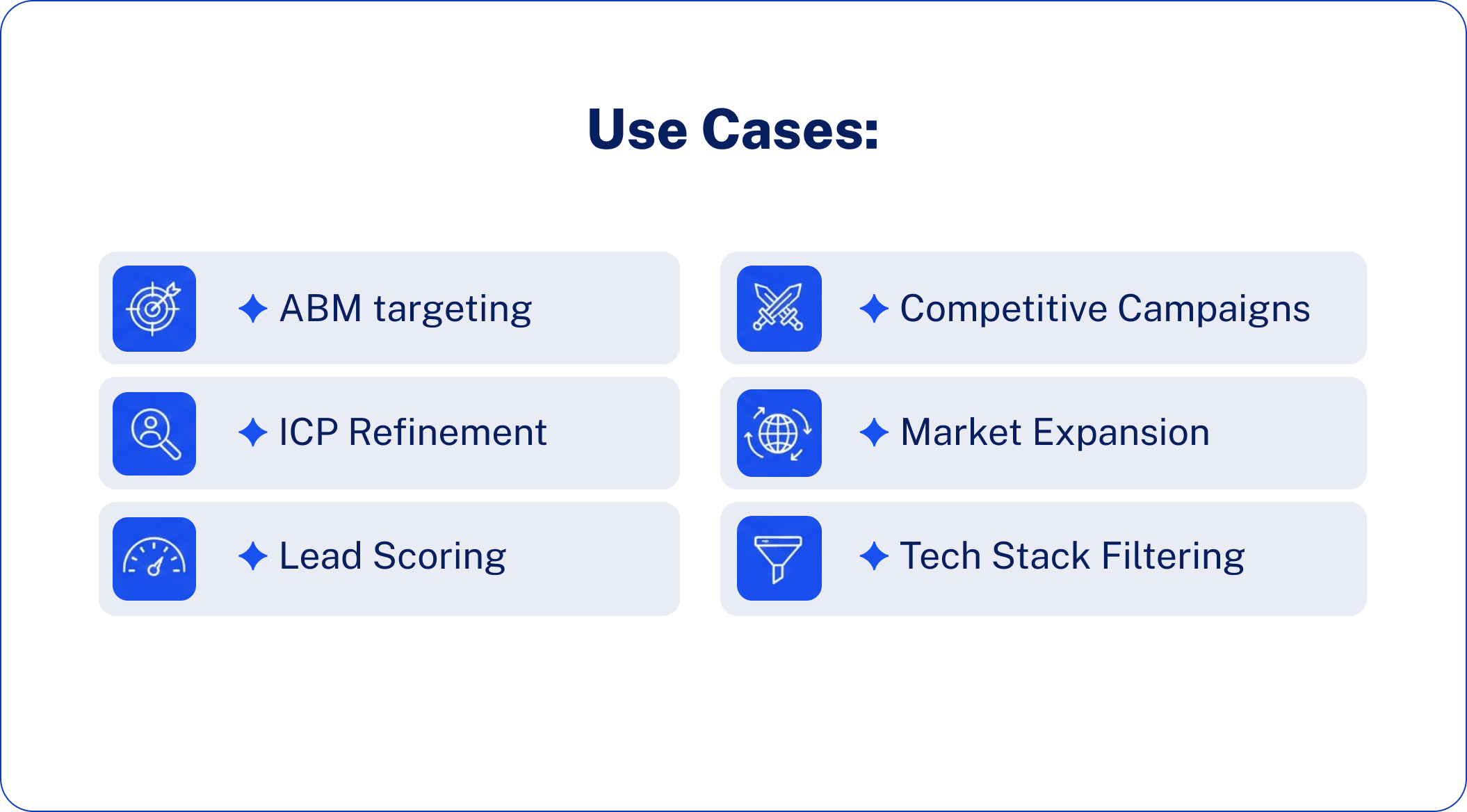

Common Use Cases of Technographic Data in 2026

Technographic data has proved to be a necessity in contemporary go-to-market teams. Ranging from optimizing your dream customer profile to launching hyper-targeted outbound campaigns, understanding what technologies your potential customers access opens up immense opportunities in sales, marketing, and revenue operations.

Here are the most common ways B2B teams are leveraging technographic data in 2026:

ABM Targeting

Precision is what account-based marketing thrives on. Technographic data offers information to identify and prioritize the accounts matching your tech-fit criteria so that your ABM efforts target companies most likely to convert.

ICP Refinement

Your ICP shouldn’t be static. Analyzing tech stacks of your best customers lets you find patterns, thus refining your ICP to target companies with similar tech footprints.

Lead Scoring

Not all leads are equal. Adding technographic signals to your scoring model helps you prioritize prospects based on:

- Tech compatibility with your product

- Technology adoption patterns

- Purchase readiness signals

- Personalization in Sales Prospecting

Cold outreach is most effective when relevant. Understanding the technology stack of a prospect enables sales representatives to tailor messages that speak directly to their current set of tools, challenges, and possible gaps.

Competitive Displacement Campaigns

It’s a proven strategy to target companies using your competitor’s products. Technographic data will show you precisely who those companies are, allowing you to position your solution as a better alternative.

Market Expansion

Considering entering a new market or vertical? Well, technographic data allows for the identification of prospective companies within that vertical space currently using complementary technologies, thus providing a warm as opposed to a cold entry point.

Tech Stack Filtering for Outbound Campaigns

Instead of spray and pray, filter your outbound lists by specific technologies. This way, every prospect you reach out to has the tech foundation that makes them a good fit for your product.

The bottom line: Whether you are in sales, marketing, or RevOps, technographic data gives you the intelligence to work smarter, not harder. The key is integrating it into your existing workflows, so real insights inform every touchpoint about your prospects.

Choosing the Right Technographic Data Provider in 2026

In 2026, technographic data isn’t a nice-to-have; it’s a competitive necessity. The ability to see what technologies your prospects use changes everything about how you target, engage with, and convert buyers.

Your ideal business provider will rely on your intentions, expenses, and go-to-market speed. To add complexity and orchestration to enterprise teams, lean to ZoomInfo or Demandbase. AI-Ark and Apollo.io will be good fits for startups and SMBs. SalesIntel is recommended to those teams that appreciate accuracy, and SMARTe is suitable for global organizations that aim at EMEA and APAC.

Take Your Technographic Targeting to the Next Level With AI-Ark

A comparison of the top 10 B2B technographic data providers leaves one thing clear: the future belongs to platforms combining AI-powered intelligence with accessible pricing.

Why settle for outdated tech stack data when you can access fresh, AI-driven insights that match your ideal customer profile?

In contrast to the complex contracts of enterprise solutions, AI-Ark has transparent credit-based pricing, GDPR-compliance, and the ability to expand as your business expands.

Get a free trial and start using AI Ark today how it makes you sharpen your targeting and close more deals.

Prefer a guided experience? Book a demo with our team.

FAQs About B2B Technographic Data Providers

1. What is a B2B technographic data provider?

A B2B technographic data supplier is a company that gathers and subsequently markets information regarding the technology stacks of firms, including software, tools, and IT infrastructure. This data is used by sales and marketing teams in order to approach prospects in a more targeted manner, to make outreach more personalized, and to identify competitive displacement opportunities.

2. How do technographic data providers collect their data?

The different providers of technographic data combine several methods: web crawling, tracking pixels, the analysis of job postings, API integrations, and AI/ML inference models. Several of these providers use human verification for quality control. In fact, the best technographic data providers combine multiple sources and refresh data regularly.

3. What’s the difference between technographic and firmographic data?

Firmographic data describes company characteristics like size, industry, revenue, and location. Technographic data uncovers the type of technologies a company utilises, for example, their CRM, marketing tools, or cloud infrastructure. It is the combination of both that yields a total understanding of whether a prospect fits their ideal customer profile.

4. How much do technographic data providers cost?

Pricing widely varies based on the provider and your needs. Some have free plans or begin as low as $25/month. Mid-range tools cost anywhere from $129–$995/month. Enterprise platforms are usually priced between $12,000–$100,000+ annually.

5. Which technographic data provider is best for startups?

The most suitable solutions are AI-Ark and Apollo.io for startups and SMBs. Both have flexible pricing, no-cost trials, and robust capabilities without the cost tags of an enterprise budget. AI Lookalike Search and 30-day refreshes are available in AI-Ark, whereas Apollo.io is offered as a one-stop shop with in-built outreach tools.